As per The Economic Times, over six vehicles priced above Rs 5 m were sold every hour, in India, in 2024.

Of course, buying luxury cars, luxury real estate and luxury accessories may not have been possible for majority of Indians.

But when it came to buying stocks trading at steep P/E multiples or ones offered at steep valuations during IPOs, Indian investors did not hesitate.

Also, quick gains on even the riskiest segments of stocks further encouraged investors to speculate on them.

Newbie investors who entered the stock markets after market crash of 2020 have yet to see a prolonged phase of market correction.

So very modest attempts at stock selection have yielded superb returns over the past four years.

But at the cost of being a spoilsport, I must warn you that the party is about to end soon.

There are too many risks to not just valuations but also to earnings growth and quality.

More importantly, with both, corporate profit margins and marketcap to GDP near historic peaks, it may take a lot for stocks to command even higher P/E multiples.

How to Find Stocks with Power to Leave Nifty in the Dust

Beating Nifty is tough for most common investors… and even for seasoned investors.

But after years of research, we’ve found 3 specific traits common among all Nifty beaters.

We believe every single investor should know about these 3 traits.

Having said that, businesses that show a meaningful path to value creation, through innovation or diversification, could be the ones to withstand any earnings or market turmoil better.

Interestingly, ex MD & CEO of Kotak Bank, Uday Kotak, recently shared a 10-point roadmap for India’s growth in 2025.

The roadmap calls for the ‘ROTI’ (Return on Time Invested) approach to seeking corporate growth. In other words, it advocates for relentless productivity in the workforce.

If you ask me, equity investors should take Mr Kotak’s suggestion more seriously.

Speculating on quick returns on bad or overrated stocks could prove to be extremely detrimental in 2025. Especially in a year when macro variables such as inflation, interest rates and geopolitical concerns are set to act as headwinds.

Therefore, looking for quality businesses that rank high on earnings productivity and holding them for long term, could be the recipe for ROTI stocks in 2025.

This also reminds me of a poignant advice offered by veteran investor Prof Sanjay Bakshi back in 2012.

Mutual Funds to Own in Modi 3.0

If you’re yet to finalize on the top funds to buy in Modi 3.0… then we highly recommend you check out this page.

PersonalFN’s research team has picked top 5 mutual funds for you.

And you can instantly access these funds with their premium mutual fund research service, FundSelect.

The best part is… for a limited time you can access our research at a fraction of what it normally costs.

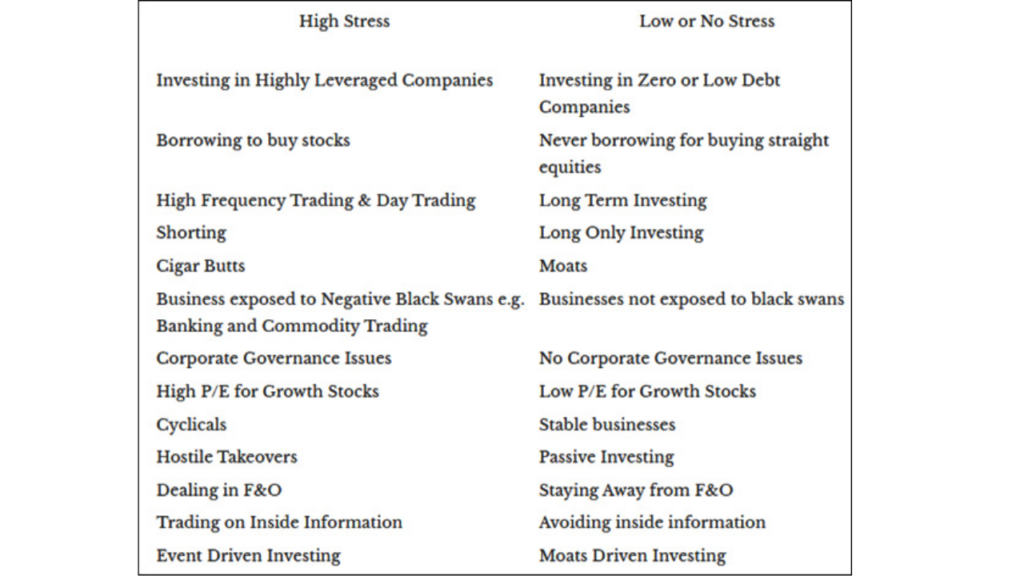

According to Prof Bakshi, once you start incorporating return per unit of stress in your investment thinking, the trade-offs become obvious.

You would start settling for stocks which offer a satisfactory return per unit of risk. Also, an investor would intuitively avert stocks which offer high returns per unit of financial risk but low returns per unit of stress.

Once the relatively low risk stocks start compounding over the years, the time invested in the stock market will automatically move up.

Plus, the ROTI approach could limit the downside risks to stocks in the event of a near term market crash.

The problem is that current valuations far exceed the economic potential and earnings growth prospects of majority of Indian stocks.

So, stock prices may not move in sync with volatility in the economy.

Also, steep valuations either follow good earnings or precede a slowdown.

So, loading up on stocks from any sector, corporate group or theme without ascertaining the intrinsic value of individual stocks is fraught with risk.

Factors Impacting Return Per Unit of Stress

Therefore, take a good look at the factors that cause a higher unit of stress in stocks, as listed above.

you may be interested in ths blog here:-

How to Create a Trading Plan: Example & Risk Management