After a stellar post Covid rebound, the Indian economy’s growth is showing signs of sobering.

The real GDP growth rate this quarter is down to 5.4%. This is much lower than the most conservative forecast or expectation. This was mirrored in the India Inc’s earnings growth as well which was at the weakest since the pandemic.

While quarterly growth numbers can vary, what makes this data worthy of your attention is the market valuations that are pricing in a very optimistic scenario.

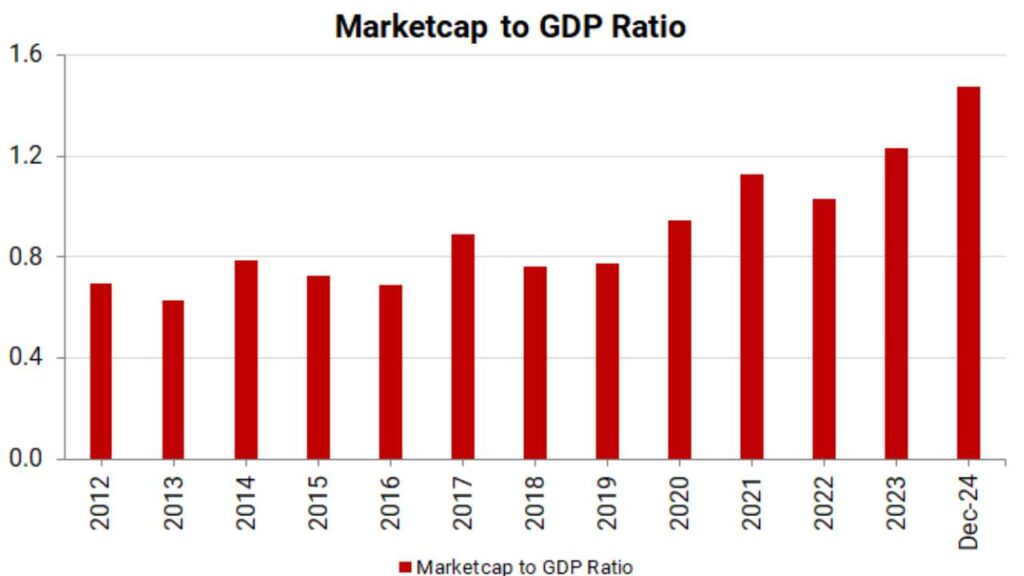

The marketcap to GDP ratio, Warren Buffett’s favorite indicator for valuations, stands 1.47 times for India versus a median of 0.9 to 1x over last decade, suggesting rich valuations.

Even if you assume a 13% nominal GDP growth rate, which is quite an optimistic figure in my view, the long term median implies that it will take three to four years for the GDP to justify the current marketcap.

This could imply a significant price or time correction in the stocks.

Time correction happens when the stock price remains stagnant, or range bound and could give lower returns than FDs. HDFC Bank’s stock performance over the last 3 years is a case in point.

Mutual Funds to Own in Modi 3.0

If you’re yet to finalize on the top funds to buy in Modi 3.0… then we highly recommend you check out this page.

PersonalFN’s research team has picked top 5 mutual funds for you.

And you can instantly access these funds with their premium mutual fund research service, FundSelect.

The best part is… for a limited time you can access our research at a fraction of what it normally costs.

Even the gold standard businesses have not been able to escape this. Avenue Supermart is a case in point where the three year returns have been negative.

And when it comes to a price correction, I think it will be a reality for many stocks, especially in the smallcap space.

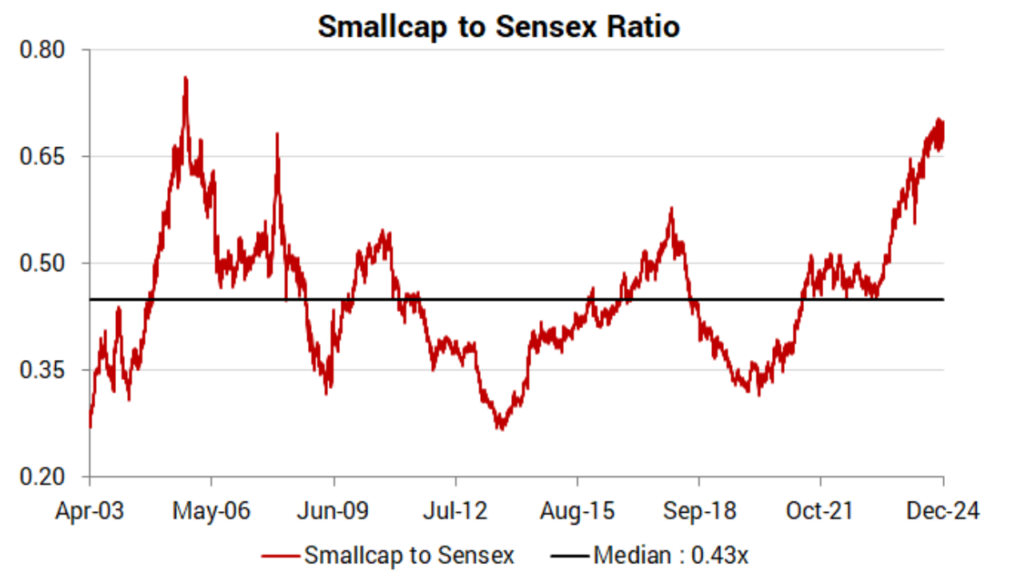

You see, the combined earnings for companies in the smallcap index is 36% of the combined earnings for Sensex companies. Against this, the smallcap to Sensex ratio, which reflects the ratio of the two benchmark indices, stands at 0.7 at present.

That in my view is a huge dichotomy and unreasonable. Historically, this ratio has been at a median of 0.45 x. Currently, it is at a huge premium to that benchmark, suggesting froth and risk in the smallcap space.

In January 2018, when the smallcap index peaked, this ratio was at 0.58x times.

And from those levels, the index had fallen 40%. And I’m not including the Covid correction.

With Covid hit, the correction in the smallcap index was over 55%.

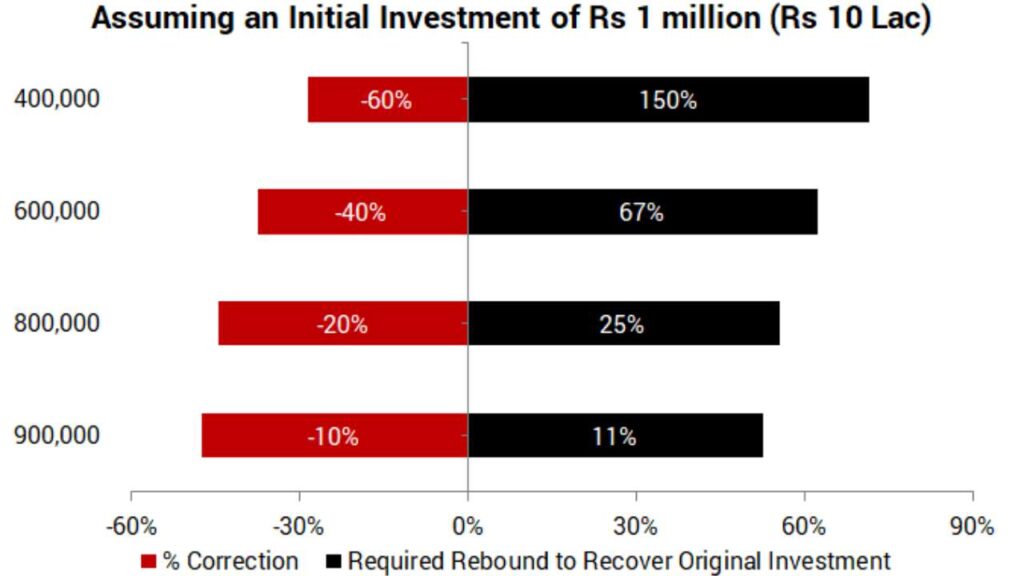

Now the thing with the corrections and rebounds is that it’s not balanced.

Let’s say you start with an investment of Rs 1 m (Rs 10 lakh) and face a 10% correction. This would reduce your investment to Rs 900,000. To make it back to Rs 10 lakh, your investment needs to grow by 11.11%.

If the correction is 20%, you will need a rebound of 25% to recover your original investment. The required rebounds for 40% and 60% correction are 67% and 150%, respectively.

And that’s just for recovery of original investment. Do note that it could take a few years before the recovery happens. And in some stocks, it could be a case of permanent capital loss.

Here’s a visual to drive home the point. The values on Y axis represent the value of investment corresponding to the correction.

We have had a glimpse of how sharp and quick correction could be on some days in recent months. While a quick recovery has dulled that shock, this rebound is more sentiment and liquidity driven than by fundamentals

you may be interested in ths blog here:-

How to Create a Trading Plan: Example & Risk Management