Introduction

Stock charts are indispensable tools for traders and investors. They offer a visual representation of price movements over time, helping users to identify trends, patterns, and potential trading opportunities. This article will uncover the secrets of reading and interpreting stock charts effectively.

Understanding Stock Charts

Stock charts display the historical price movements of a security over a specific period. They help traders analyze trends, support and resistance levels, and other important factors.

Types of Stock Charts:

- Candlestick Charts Candlestick charts provide a detailed view of price movements within a specific period. Each candlestick represents the open, high, low, and close prices for that period.

- Advantages: Offers more information than line charts and helps identify patterns.

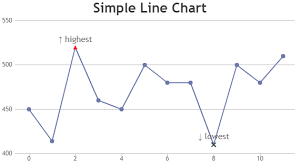

- Line Charts Line charts simplify price movements by connecting the closing prices over a period. They are useful for identifying long-term trends.

- Advantages: Easy to read and understand, ideal for identifying overall trends.

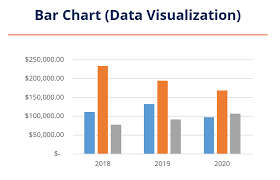

- Bar charts show the open, high, low, and close prices for each period in a vertical bar format. They offer a detailed view similar to candlestick charts.

- Advantages: Provides detailed price information and helps in pattern recognition.

Essential Chart Patterns

Recognizing key chart patterns can give you insights into potential market movements.

1. Head and Shoulders The Head and Shoulders pattern indicates a reversal in the trend. The Head and Shoulders Top signals a bearish reversal, while the Head and Shoulders Bottom (Inverse) indicates a bullish reversal.

- Confirmation: Look for a break of the neckline and confirm with volume.

2. Double Top and Double Bottom A Double Top pattern suggests a potential bearish reversal after an uptrend, while a Double Bottom indicates a potential bullish reversal after a downtrend.

- Confirmation: Confirm with a break of the neckline and additional indicators.

3. Flags and Pennants Flags and Pennants are continuation patterns that indicate a brief consolidation before the previous trend resumes. Flags are rectangular, while Pennants are triangular.

- Confirmation: Look for a breakout in the direction of the previous trend.

How to Analyze Stock Charts

Combining Patterns with Technical Indicators: Use technical indicators like Moving Averages, RSI, and MACD to complement your chart pattern analysis. These indicators can provide additional confirmation and help validate patterns.

Identifying Trends: Analyze the overall trend by examining moving averages and trend lines. Determine whether the market is in an uptrend, downtrend, or consolidation phase.

Support and Resistance Levels: Identify key support and resistance levels on the chart. These levels indicate where the price may reverse or stall.

Conclusion

Unlocking the secrets of stock charts can greatly enhance your trading strategy. By understanding different chart types, recognizing patterns, and combining chart analysis with technical indicators, you can make more informed trading decisions. Continuous practice and analysis will help you become more proficient in using stock charts for successful trading.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis

Ultimate Guide to UKG Math Worksheet PDF Free Download

Advanced OOP Concepts in SAP ABAP A Comprehensive Guide

Tags: how to invest in stock market, how to invest in stocks

Tags: #CandlestickPatterns, #InvestmentTips, #StockMarket, #TechnicalAnalysis, #TradingStrategies