Introduction:

In the fast-paced world of trading, recognizing bearish signals is crucial for protecting your investments and capitalizing on market downturns. The Bearish Belt Hold pattern is one such signal, offering traders a clear indication of a potential reversal from an uptrend to a downtrend. Understanding and incorporating this pattern into your trading strategies can make the difference between a profitable trade and a missed opportunity.

Imagine you’re sailing on a calm sea when suddenly, dark clouds gather on the horizon. This shift in weather is like the Bearish Belt Hold pattern—a warning sign that stormy conditions may be ahead. In this article, we’ll explore the Bearish Belt Hold pattern, how to identify it, and how to use it effectively in your trading strategies.

Understanding the Bearish Belt Hold Pattern

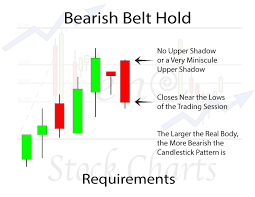

The Bearish Belt Hold patterns is a single candlestick formation that typically appears after a prolonged uptrend. It signals a potential reversal, indicating that the bulls may be losing their grip on the market, and the bears are preparing to take control.

What Does It Look Like?

- Opening Price: The candle opens at or near its high for the period, reflecting strong buying pressure at the start.

- Body: The candle has a long body, showing that sellers have taken over, driving the price down significantly from the opening level.

- No or Very Short Lower Shadow: The absence or minimal presence of a lower shadow suggests that the sellers maintained control throughout the trading session.

Trading Strategies for the Bearish Belt Hold Pattern

Step 1: Identifying the Pattern

Look for the Bearish Belt Hold patterns after a sustained uptrend. This is crucial, as the pattern’s significance is most apparent when it marks the potential end of an upward move.

Step 2: Confirming the Reversal

Before making a trade based on the Bearish Belt Hold pattern, it’s essential to confirm the reversal with other technical indicators or chart patterns. For example, a break below a key support level or a bearish crossover in moving averages can add weight to the pattern’s signal.

Step 3: Setting Your Entry and Exit Points

To trade the Bearish Belt Hold patterns, consider entering a short position when the next candle opens below the Bearish Belt Hold candle’s low. Use a stop-loss above the pattern’s high to manage risk. Your profit target can be set based on the next significant support level or using a trailing stop to capture more of the potential downtrend.

Step 4: Monitoring the Trade

Keep a close eye on the trade and be prepared to adjust your strategy if the market shows signs of reversing again. Using trailing stops can help you lock in profits as the market moves in your favor.

Common Pitfalls to Avoid

Mistake 1: Ignoring Market Conditions

The Bearish Belt Hold patterns should be analyzed in the context of the overall market environment. If the pattern appears during a strong bull market without other bearish signals, it may not indicate a significant reversal.

Mistake 2: Overconfidence in the Pattern

While the Bearish Belt Hold patterns can be a powerful indicator, relying solely on it without considering other factors can lead to poor trading decisions. Always confirm the pattern with additional analysis.

The Bearish Belt Hold in Different Markets

Stocks

In stock trading, the Bearish Belt Hold pattern often signals the end of a rally, providing a shorting opportunity. It is especially effective when found near resistance levels or after a period of overbought conditions.

Forex

Forex traders can use the Bearish Belt Hold patterns to identify potential reversals in currency pairs. However, due to the influence of macroeconomic factors, it’s advisable to use this pattern alongside fundamental analysis.

Commodities

In commodities markets, the Bearish Belt Hold patterns may indicate a shift in supply-demand dynamics. It can be particularly useful for short-term traders looking to capitalize on market corrections.

Cryptocurrencies

Given the volatility in cryptocurrency markets, the Bearish Belt Hold pattern can signal a rapid shift in sentiment. However, due to the noise in these markets, it should be used in conjunction with other technical indicators.

Conclusion

The Bearish Belt Hold pattern is a key signal for traders looking to anticipate market downturns and adjust their strategies accordingly. By understanding how to identify this pattern and applying it within the context of broader market analysis, you can enhance your ability to navigate bearish conditions effectively.

Always remember that no single pattern guarantees success. The Bearish Belt Hold pattern should be one tool in your broader trading strategy, used alongside other indicators and market analysis techniques.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis