Introduction:

In technical analysis, continuation patterns play a crucial role in helping traders identify the potential for an ongoing trend to continue. The Mat Hold pattern is one such continuation pattern that signals a pause in the current trend, followed by a resumption in the same direction. Understanding and recognizing this pattern can be a valuable asset for traders looking to capitalize on sustained market movements.

Picture a marathon runner who slows down to take a breath but then picks up speed again to continue the race. The Mat Hold pattern is similar to this brief pause—a consolidation phase that

often leads to the continuation of the prevailing trend.

In this article, we’ll explore the Mat Hold patterns, its formation, and how traders can use it to confirm trend continuation and make informed trading decisions.

Understanding the Mat Hold Pattern

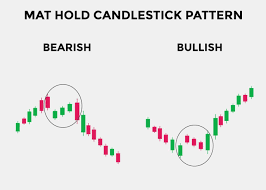

The Mat Hold patterns is a multi-candlestick pattern that typically appears during a strong trend. It consists of a series of candles that reflect a temporary pause or consolidation in the trend, followed by a resumption of the previous direction.

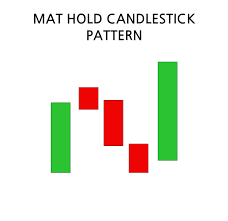

What Does It Look Like?

- First Candle: A large bullish (in an uptrend) or bearish (in a downtrend) candle that confirms the existing trend.

- Middle Candles: A series of smaller candles that form in the opposite direction of the trend, indicating a brief consolidation or pullback.

- Final Candle: A large candle in the direction of the original trend, confirming the continuation of the trend.

Why the Mat Hold Pattern Matters

The Mat Hold patterns is significant because it provides traders with a clear signal that the current trend is likely to continue after a brief pause. This pattern allows traders to enter or add to their positions with greater confidence, knowing that the market is likely to move in their favor.

How to Trade the Mat Hold Pattern

Step 1: Identify the Pattern

To trade the Mat Hold patterns, start by identifying it within the context of a strong, existing trend. The pattern is most effective when it occurs after a significant price movement, indicating that the market is taking a brief pause before continuing.

Step 2: Confirm the Continuation

Before entering a trade based on the Mat Hold patterns, confirm the continuation of the trend with additional technical indicators or chart patterns. For example, you might look for a breakout above a resistance level (in an uptrend) or below a support level (in a downtrend) as further confirmation.

Step 3: Plan Your Trade

Once the Mat Hold patterns is confirmed, consider entering a position in the direction of the prevailing trend. Use the final candle in the pattern as a guide for your entry point. For risk management, place a stop-loss below the consolidation phase in an uptrend or above it in a downtrend.

Step 4: Manage the Trade

As with any trading strategy, it’s essential to monitor your trade and adjust your strategy as the market evolves. Consider using a trailing stop to protect your profits as the trend continues.

Common Mistakes to Avoid

Mistake 1: Misinterpreting the Pattern

One common mistake is misidentifying the Mat Hold pattern, especially during periods of low market volatility. Ensure that the pattern you’re analyzing occurs within a strong trend and that the middle candles represent a clear consolidation phase.

Mistake 2: Ignoring Confirmation

While the Mat Hold patterns is a strong continuation signal, it’s important to wait for confirmation before entering a trade. Jumping in too early can result in losses if the trend fails to continue.

The Mat Hold Pattern in Different Markets

Stocks

In the stock market, the Mat Hold patterns can signal the continuation of a bull or bear run, providing an opportunity for traders to ride the trend. It is especially useful for swing traders looking to capitalize on medium-term price movements.

Forex

Forex traders can use the Mat Hold pattern to confirm the continuation of a trend in currency pairs. This pattern is particularly effective in trending markets where economic fundamentals support the existing trend.

Commodities

The Mat Hold pattern can be a valuable tool in commodities trading, where trends often persist due to supply-demand dynamics. Traders can use this pattern to stay in a trade during brief pullbacks, maximizing their potential gains.

Cryptocurrencies

In the volatile world of cryptocurrencies, the Mat Hold pattern can help traders identify opportunities to stay in a trend during periods of consolidation. However, due to the high volatility, it’s important to use this pattern alongside other technical indicators.

Conclusion

The Mat Hold pattern is a powerful continuation signal that can help traders identify opportunities to capitalize on ongoing trends. By understanding how to recognize this pattern and applying it within the context of broader market analysis, traders can improve their chances of making profitable trades.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis