Putting resources into the securities exchange frequently requires understanding the classifications of stocks to pursue informed choices. Two significant classes financial backers experience are recurrent and non-repetitive stocks. These orders assist financial backers with distinguishing how an organization’s presentation lines up with the more extensive monetary cycle, making them significant for portfolio expansion and chance administration.

In this blog, we’ll investigate the critical contrasts among repeating and non-recurrent stocks, their attributes, models, and when to think about putting resources into each.

What Are Cyclical Stocks?

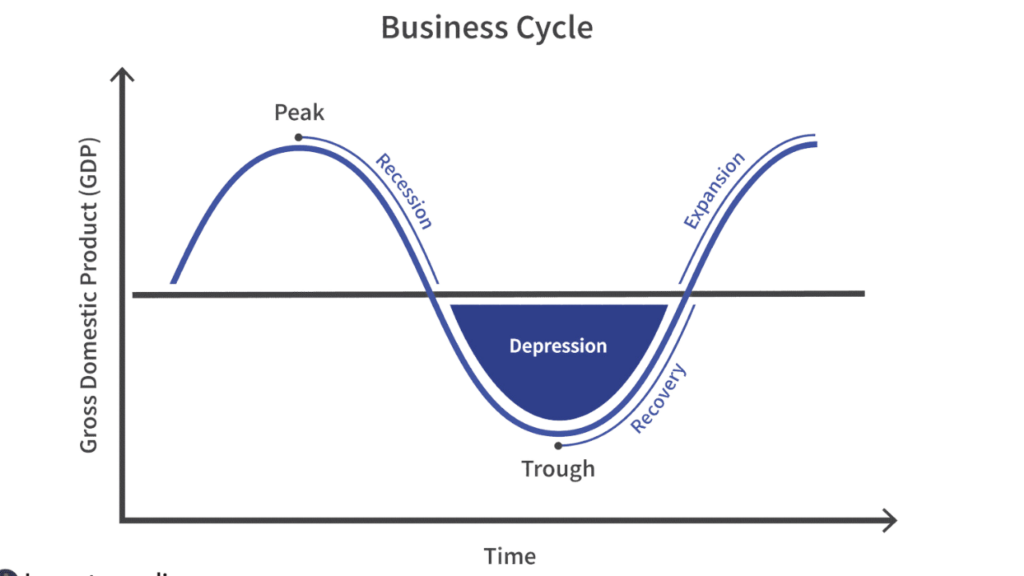

Repetitive stocks are portions of organizations whose business execution is intently attached to the financial cycle. These stocks ascend during times of financial development and extension, and they fall during downturns or monetary stoppages. The interest for labor and products from organizations in repeating enterprises will in general be higher when the economy is getting along nicely and lower during financial slumps.

Repetitive ventures incorporate areas that offer items and administrations shoppers or organizations will generally buy a greater amount of when they have positive expectations about their monetary circumstance and the economy is growing. On the other hand, during difficult stretches, these ventures ordinarily experience a decrease popular, prompting a decline in stock costs.

Key Characteristics of Cyclical Stocks:

- Monetary Responsiveness: The exhibition of recurrent stocks is exceptionally corresponded with financial circumstances.

- Instability: These stocks can be more unstable, offering potential for critical increases during great times and huge misfortunes during monetary slumps.

- Models:

- Vehicle Industry: Organizations like Passage and General Engines frequently see higher deals during periods of prosperity as shoppers are more ready to make first-class buys.

- Retail Area: Top of the line retail marks, for example, extravagance products organizations, see expanded request when shoppers have more discretionary cashflow.

- Travel and Recreation: Aircrafts, journey lines, and inn networks areas of strength for are during times of monetary development yet endure during downturns.

- Innovation: While tech organizations can be repeating, this area’s presentation can likewise be driven by development and the interest for new items.Monetary Responsiveness: The exhibition of recurrent stocks is exceptionally corresponded with financial circumstances.

- Instability: These stocks can be more unstable, offering potential for critical increases during great times and huge misfortunes during monetary slumps.

- Models:

- Vehicle Industry: Organizations like Passage and General Engines frequently see higher deals during periods of prosperity as shoppers are more ready to make first-class buys.

- Retail Area: Top of the line retail marks, for example, extravagance products organizations, see expanded request when shoppers have more discretionary cashflow.

- Travel and Recreation: Aircrafts, journey lines, and inn networks areas of strength for are during times of monetary development yet endure during downturns.

- Innovation: While tech organizations can be repeating, this area’s presentation can likewise be driven by development and the interest for new items.

Why Are Cyclical Stocks Important?

Repeating stocks give open doors to critical returns when the economy is in a development stage. Financial backers frequently purchase repetitive stocks fully expecting monetary development, which can prompt expanded buyer spending and higher benefits for organizations in these ventures. Be that as it may, these stocks likewise accompany higher dangers, particularly assuming the economy takes a slump.

For instance, during the 2008 monetary emergency, repeating stocks like aircrafts, automakers, and development organizations saw their stock costs dive as the economy contracted. In any case, as the economy bounced back in resulting years, these stocks recovered their worth and, surprisingly, surpassed past highs.

What Are Non-Cyclical Stocks?

Non-repetitive stocks, likewise alluded to as guarded stocks, are portions of organizations whose exhibition isn’t as intently attached to the financial cycle. Dissimilar to repetitive stocks, non-repeating stocks will more often than not stay steady or even perform well during monetary slumps on the grounds that the items and administrations these organizations offer are fundamental and in consistent interest.

Non-repetitive enterprises are commonly described results and administrations that individuals need no matter what their monetary circumstance or financial circumstances. Whether the economy is in a development stage or downturn, the interest for these merchandise remains somewhat steady.

Key Characteristics of Non-Cyclical Stocks:

- Monetary Security: Non-repeating stocks are less influenced by financial vacillations.

- Cautious in Nature: These stocks will generally give consistent returns and can go about as a fence during times of market unpredictability.

- Models:

- Utilities: Organizations that give power, gas, and water, like Duke Energy or Public Lattice, are fundamental administrations that keep on seeing interest in any event, during monetary downturns.

- Shopper Staples: These incorporate organizations that fabricate ordinary things like food, refreshments, and cleaning items. Models incorporate Procter and Bet, Coca-Cola, and Unilever.

- Medical services: Drug organizations, emergency clinics, and clinical gadget makers like Johnson and Johnson or Pfizer will quite often perform well even in extreme monetary times since medical care needs are undeniable.

- Broadcast communications: Organizations like AT&T and Verizon offer fundamental types of assistance that individuals keep on utilizing no matter what the condition of the economy.

Why Are Non-Cyclical Stocks Important?

Non-repetitive stocks are viewed as a more secure venture choice, particularly in the midst of financial vulnerability. These stocks are in many cases pursued by moderate financial backers searching for consistent pay and steadiness. They are less unpredictable than repetitive stocks, which makes them an appealing choice for risk-unwilling people or those hoping to adjust their portfolio during times of market shakiness.

During the Coronavirus pandemic, for instance, non-repetitive areas, for example, medical care and purchaser staples performed generally well, while repeating areas like travel, recreation, and diversion saw critical misfortunes.

The Key Differences Between Cyclical and Non-Cyclical Stocks

While both repeating and non-recurrent stocks assume significant parts in a broadened portfolio, they offer different gamble reward profiles and fill unmistakable needs in speculation techniques. The following are the principal distinctions between the two:

Characteristic Cyclical Stocks Non-Repeating Stocks

Financial Sensitivity Highly delicate to the monetary cycle. Less impacted by monetary vacillations.

Execution in Great Times Perform well during times of financial growth. Perform consistently paying little heed to monetary development.

Execution in Recessions Perform inadequately during recessions. Tend to stay steady or even perform well.

Volatility More unpredictable with higher gamble and reward. Less unstable and more steady.

Examples Automobiles, extravagance merchandise, travel, construction. Utilities, medical services, customer staples.

Risk Level Higher risk due to financial dependence. Lower risk because of fundamental nature of items.

Repeating Stocks: Development and Hazard

Repeating stocks will quite often beat in flourishing economies in light of the fact that their items and administrations are more sought after. In any case, they additionally convey the gamble of losing esteem altogether when the economy contracts. A financial backer who comprehends the monetary cycle can exploit recurrent stocks’ presentation during periods of prosperity yet ought to be mindful during downturns.

Non-Repeating Stocks: Solidness and Consistency

Non-repeating stocks are many times considered a place of refuge during monetary slumps on the grounds that their items are fundamental. While these stocks may not convey similar fast gains as repetitive stocks during seasons of monetary extension, they offer reliable returns and are less inclined to encounter steep downfalls during market declines.

Why Understanding Cyclical and Non-Cyclical Stocks is Important for Investors

For both beginner and experienced financial backers, understanding the contrast among repetitive and non-recurrent stocks is pivotal for fostering a fruitful speculation methodology. The following are a couple of motivations behind why this qualification matters:

Broadening: Having both repetitive and non-repeating stocks in your portfolio considers better expansion. This lessens the general gamble by offsetting high-learning experiences with steady, cautious ventures.

Risk The executives: Assuming you’re risk-disinclined, you could incline toward non-repeating stocks, which offer greater strength. Then again, in the event that you’re a development situated financial backer with a higher gamble resistance, you could zero in on repetitive stocks.

Monetary Cycle Mindfulness: Understanding when to move among repetitive and non-repeating stocks in view of the financial cycle can upgrade your venture returns. For example, as the economy begins to recuperate from a downturn, repetitive stocks might see critical increases, while non-repeating stocks could encounter lower development rates.

Building a Versatile Portfolio: Recurrent stocks can bring more significant yields, yet they accompany expanded risk, while non-repeating stocks go about as a stabilizer during violent economic situations. An even portfolio that incorporates the two kinds of stocks can assist you with exploring different financial situations successfully.

Conclusion

Taking everything into account, repeating and non-repetitive stocks address two distinct ways to deal with financial planning, each with its own arrangement of benefits and dangers. Understanding these distinctions is crucial to building a powerful speculation methodology that lines up with your monetary objectives and chance resistance.

Repetitive stocks are the most appropriate for the individuals who can deal with market unpredictability and are hoping to exploit financial development.

Non-recurrent stocks, then again, offer soundness and steady returns, particularly during monetary slumps.

By integrating both repetitive and non-repeating stocks into your portfolio, you can exploit financial expansions while shielding your speculations during slumps. Continuously recall that expansion is critical, and being aware of how various areas respond to monetary circumstances can be the contrast between a wise venture methodology and an extraordinary one.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights