When Genius Fails

What attributes would you seek for when selecting someone to manage your investment funds?

You want them to be trustworthy and knowledgeable, and you’re more inclined to choose someone with a strong reputation for networking and intelligence.

If you get three of these guys, say two Nobel Memorial Prize winners, you’ll be willing to pay more for their ‘expertise’.

Investors in LTCM, a hedge fund created in 1994 by three geniuses, had high expectations for their investment. Unfortunately, these were not met.

The fund failed and needed to be bailed out in 1998.

Why IQ is Not Enough

Humans are subject to many emotions – fear, greed, loss aversion, denial, external validation.

So this is easier said than done. The costs of biases can be huge.

This is one of the reasons why algorithmic trades or system based investing, that claim to keep human biases out of decision making, has been gaining ground.

While there is some merit in this approach, I feel while trying to avoid bad decision making, it can also deprive you of qualitative insights that add a strong alpha to one’s investment returns.

Wouldn’t it be good if we were aware, could self-reflect, and manage our emotions and behaviours well, rather than being a victim to them?

That’s where the importance of stock market psychology and importance of right temperament kick in.

How to Find Stocks with Power to Leave Nifty in the Dust

Beating Nifty is tough for most common investors… and even for seasoned investors.

But after years of research, we’ve found 3 specific traits common among all Nifty beaters.

We believe every single investor should know about these 3 traits.

What is Stock Market Psychology?

Stock markets are made up of humans who trade stocks, based on their knowledge. They are driven by their individual biases and behaviours.

When these individuals come together, what you are dealing with is stock market psychology.

How you respond to it will determine how far you will go, and how soon and hard you may fail.

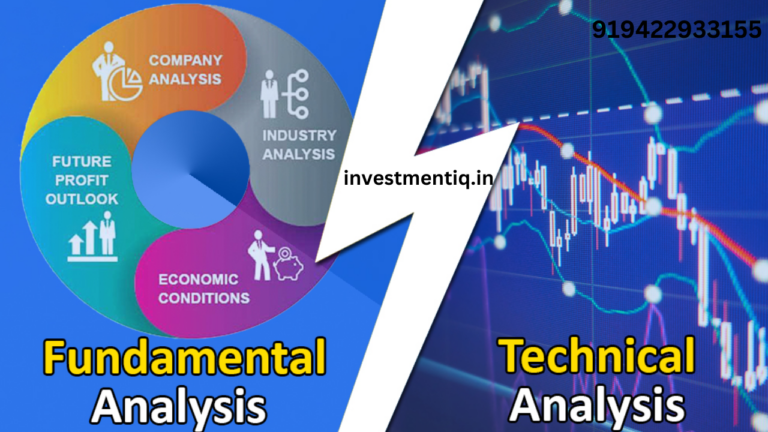

Stock market psychology is one of the basic components of investing decisions along with stock research.

Psychology is a subject that best helps us understand human nature and emotions. It helps us to know why people feel, think, and act the way they do.

Human nature and emotions remain the same irrespective of era one is in. People were greedy and fearful even a hundred years back as much as they are now.

As such, understanding and developing right response to it, is as important as knowledge, experience, and skill in investing success.

While investing emotions often cloud our decision-making. It’s very difficult to conquer our inherent emotional biases.

That said, we can understand the range of emotions we may experience as an investor and how it affects our interaction with the stock markets.

Greed, fear, hope, euphoria, panic among others are the range of emotional biases that every trader comes across while trading. To be successful investor we need to keep these emotions in check.

Some Examples

You heard about a stock from your friends that he feels has good potential, and is trading at Rs 70.

You come back home, take a few days reading and researching everything on it, like it and decide to buy it.

However, just when you are about to place that order, you stop. The reason – the same stock is now trading at Rs 80.

And you are not comfortable buying it at a price higher that you first saw. You feel you are overpaying.

Your decision doesn’t stem from any assessment of upside potential in the stock, but just the first information you had about the stock.

You decide to wait for a correction. Over next few months, the stock price triples.

You kick yourself for not acting when you should have.

This is an instance of anchoring bias.

Mutual Funds to Own in Modi 3.0

If you’re yet to finalize on the top funds to buy in Modi 3.0… then we highly recommend you check out this page.

PersonalFN’s research team has picked top 5 mutual funds for you.

And you can instantly access these funds with their premium mutual fund research service, FundSelect.

The best part is… for a limited time you can access our research at a fraction of what it normally costs.

Let’s consider another situation.

You’re interested in cryptocurrencies and you buy some bitcoin.

You don’t understand much about it. You’ve heard it could be the currency of the future. You’ve seen the recent gains. You believe it could rise further.

In short, you are in the grip of fear of missing out (FOMO). You end up investing a big amount in it, hoping for an early retirement.

It’s all good when the bitcoin is surging ahead. One fine day, Mr Musk tweets about the environmental damage it causes. The bitcoin crashes 30% in a day.

You hate that guy.

You check your twitter group, and find a thread where people are discussing this. You find a tweet from someone who is still confident of bitcoin’s prospects. His comments bring you comfort.

You seek out and share every article in bitcoin’s support, and start unfollowing people who share the other view. You even start your WhatsApp group, asking only bitcoin investors to join, and skeptics to keep away.

That’s confirmation bias. It means you will only tend to listen to people who share your views. In investing, falling a prey to this bias could lead to irrational decisions.

Here’s another example.

A hot stock from the chemical sector you bought two months ago, has fallen 20% in a day on the posting bad results.

The next day, there is the news of CFO resigning. The stock falls another 10%. You still maintain faith in the management and keep holding.

Next week, there is an announcement of the company suspending its capex plan due to environmental compliance issue.

As you check the ticker, the stock is now down 40% from your buy price. It’s evident that such a development will have adverse impact on future business growth. Yet, you continue to hold, assuming the worst is factored it. Afterall, how low can it go?

Psychological studies suggest that pain of losing is at least twice as powerful as pleasure that comes from gains. This explains why people are averse to cut losses, even when all the data and research suggests that there could be further downside.

That’s loss aversion bias.

How to Manage Investing Biases and Develop the Right Temperament

I have picked some specific examples to highlight some of the prevalent biases.

But the list is so long that it would require a book, and perhaps a sequel, to put light on the spectrum of human behaviours that could jeopardise investment returns.

So having come to that understanding, let’s see how we can eliminate or minimise the impact of biases.

In my decade long experience in investing, I have realised that laying out a process helps. It disciplines you to operate within the discipline and not let your emotions override your rationale.

Here’s what you can do.

- Stick to your circle of competenceCharlie Munger has said “knowing what you don’t know is more useful than being brilliant”.You don’t have to make a speculative bet on next ‘Amazon’ if you do not have any insights on what it takes to be one and whether the set of companies you are looking at have that quality.You see, the size of circle, as Warren Buffett says, is not important. Knowing its boundaries, however, is vital.This will help avoid specualtions. When you invest based your own conviction, rather than a borrowed one, you can define a clear process and identify triggers that warrant action in terms of buying or selling.Else you will be keep looking for clues outside and will always be late in taking the right decision.

- Allocate WellBoth academic and real world studies have proven that the decisions one makes regarding the mix of assets (or stocks) has far more influence on investing success than market timing or picking individual stocks.If you think about it, when you are too much exposed to a particular asset class, it’s difficult to not feel the emotions that come from volatility in it.

- Seek Disconfirming EvidenceYou are not married to a stock you invest in. In the world when what you search and see on internet on investments is being tracked and managed by algorithms, take extra pain to reach out to individuals that hold a different view and always invert.A tendency to be willing to find flaws in your own hypothesis could help you avoid making risky trades and could help you cut losses. If your hypothesis doesn’t hold true in light of new stocks, be willing to exit.

- Don’t CompareInvesting is a world where success stories gain a lot more circulation than failures. Different investment styles work at different phases.But gullible investors tend to follow big investors or popular trades, driven by a fear of missing out.While stories have a great recall value, they are no match to facts and detailed analysis in investing.So plan your investments as per your own financial goals and risk temperament, rather than imitating the crowd.

- Differentiate Price from ValueOwning a stock is like owning a part of the business one invests in. Price is just a variable indicative of demand and supply of a stock on a particular day or moment.It may or may not reflect the true value of your investment. Have a long term horizon, as it may take some time for the price align with fundamentals.So rather than being obsessed with stock price, be obsessed with the real value and margin of safety in your investments. You will be able to navigate volatility and human emotions a lot better than your peers.

Last but not the least, have a tolerance for occasional failures.

Not even the best of investing track records are without a fair share of calls gone wrong. You don’t have to forsake a process because it did not work with a particular stock investment.

If you learn to accept that, even despite a few failures, chances are you will do well on an overall basis.

Conclusion

Investing is simple, but not easy.

Along with a basic understanding of financials and valuations, it requires a high degree of EQ.

Investing biases, impulsive and irrational behaviors can interfere with logic yielding to sub-par performance, sometimes even losses.

As humans, we cannot eliminate emotions but there is definitely a way you can identify them, reflect on them, and manage them to make the most of your investments.

you may be interested in ths blog here:-

How to Create a Trading Plan: Example & Risk Management