In my previous editorial, I emphasized the importance of exercising caution rather than greed in current situations.

The slowdown in earnings growth, the high marketcap-to-GDP ratio, the high smallcap-to-Sensex ratio, and the overall risk-reward equation all appear to be against the odds. If there is no price correction, some high-flying equities are likely to see a time correction.

As a result, investors would do well to maintain a conservative asset allocation and a margin of safety in their purchasing levels. However, the situation is not entirely terrible.

Take a peek.

You see what’s happening here.

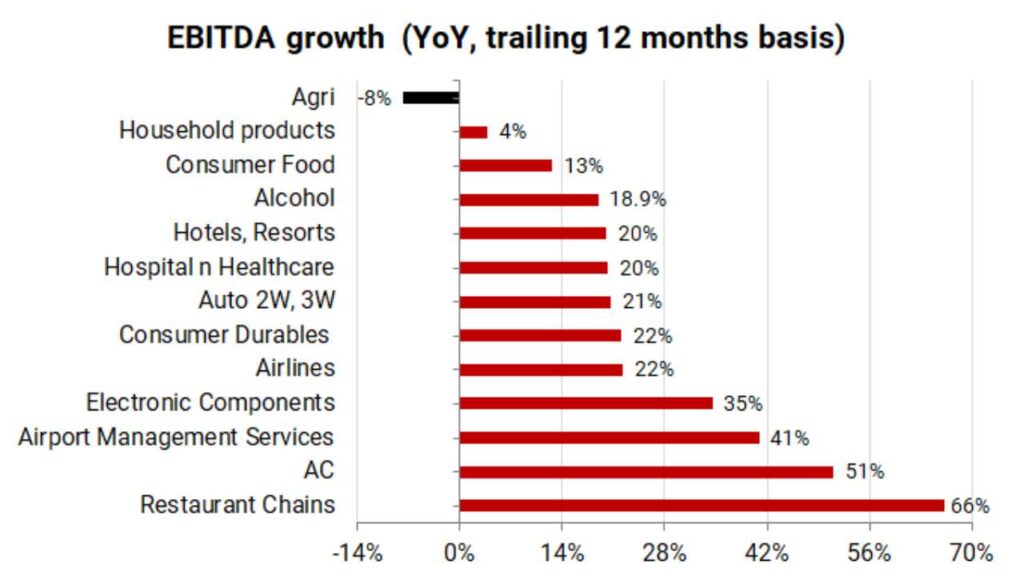

In sectors such as agri and FMCG, that cater to masses, the operating profit growth has been the slowest.

How to Find Stocks with Power to Leave Nifty in the Dust

Beating Nifty is tough for most common investors… and even for seasoned investors.

But after years of research, we’ve found 3 specific traits common among all Nifty beaters.

We believe every single investor should know about these 3 traits.

The business for AC makers and sellers and restaurant chains, however, is booming.

The categories above 15% growth in the chart are indicative of the grim ground realities of the Indian economy – the great divide between the rich and the poor, and it’s widening.

Creating wealth while focusing on the bottom of the pyramid is getting difficult.

No wonder then that the FMCG firms working in the affordable category are struggling with growth. And most of the launches in the recent times have been in the premium category.

The higher you move on the premium ladder, the better your chances of having a booming business.

Alcohol, airlines, hospitals, electronic components, and hotels/resorts… the economy beating growth in these sectors suggests the affluent class is leading the growth.

There is a clear rise in discretionary spend, and a slowdown in the industries targeting the masses…the bottom of the pyramid section of the economy.

So what could this mean for investors?

I have been writing about this for some time now.

Premiumisation is an ongoing megatrend.

Rising share of SUVs, booming sales of iphones, luxury real estate sales beating the affordable ones, rising international travel… the theme is in working wherever you focus on.

Here’s an interesting observation for you.

In FY24, Apple’s revenue from India has crossed US$ 8 bn, surpassing HUL’s revenues.

The word luxury was mentioned 11 times in DLF’s earnings concall.

If you’re yet to finalize on the top funds to buy in Modi 3.0… then we highly recommend you check out this page.

PersonalFN’s research team has picked top 5 mutual funds for you.

And you can instantly access these funds with their premium mutual fund research service, FundSelect.

The best part is… for a limited time you can access our research at a fraction of what it normally costs.

You see, there is indeed a case of getting wealthy by capitalising on the premiumisation trend.

And in that case, here’s a watchlist that you should keep an eye on.

Titan – From watches, to jewelleries to saarees, and eyewear… Titan is a brand associated with luxury.

Ethos – It’s India’s largest luxury and premium watch retail player.

Brand Concepts – The company collaborates with top international and domestic brands through exclusive license agreements to develop, market, and sell lifestyle and fashion accessories. The brands it has associated with include Tommy Hilfiger, United Colors of Benetton, Juicy Couture, Aeropostale, etc.

Landmark Cars – It’s the leading premium automotive retail business in India with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen, and Renault. For many of these, it is the number one partner in India with a leading share in sales.

Wonderla Holidays – While it’s not a luxury, the rise of affluence in India is likely to brush on entertainment segment, especially ride parks. The company is all set for pan India expansion to make the most of the first mover advantage in an underpenetrated country.

Pricol – This auto ancillary player offers Driver Information and Connected Vehicle Solutions (DICVS). Products like speedometer, sensors, telematics, e cockpits, TFT clusters, heads up displayers, and instrument clusters account for 65% of its revenues.

The company is a market leader in its niche and enjoys a 50% market share in domestic two wheelers, 58% in commercial vehicles and 96% in the off-road segment. It’s scaling up the kit value while premiumising the product portfolio

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights