Introduction:

Trading is a high-risk career with larger stakes than you realize, but it can also be extremely profitable if done correctly. A professional trader understands that trading is only 10%, and the remaining 90% is psychology. If you can grasp the psychology of trading, you’ll have practically cracked the trading code. Psychology is an important aspect in trading; it can make or break a trader in the market.

Today we will look at the psychology of trading, the fundamental psychological aspects that influence trading, and how to control and improve your trading mindset.

Importance of Psychology in Trading:

- Psychology plays an important influence in the trading process. The emotional aspect of a trader influences their decision-making and the outcome.

- A trader is also a human person born with basic emotions and a specific perspective, as seen by their trades and the reasons behind them. Psychology is an important role in decision making and the difference between losing and succeeding traders.

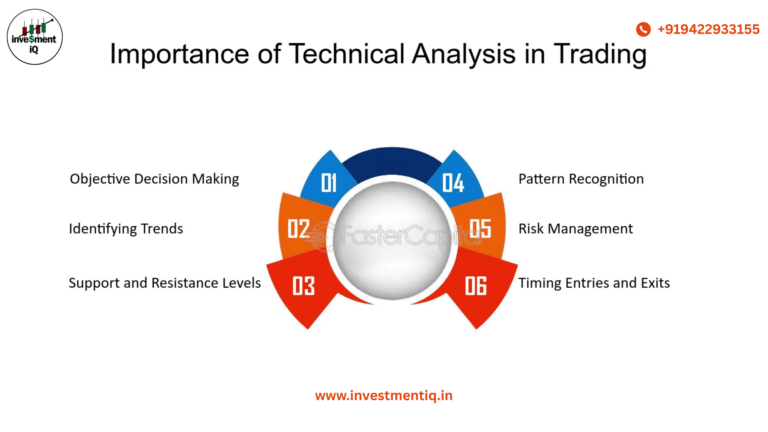

- Even if you have mastered the depths of the market, such as technical and fundamental analysis, it will fail unless you have the right attitude. A shattered thinking will never allow you to keep your profits or cut smaller losses.

- If you are in a small profit, a broken mindset will tell you to play it safe and exit as soon as possible, which will never allow you to make larger profits. Similarly, if you are in a loss and clearly see that your strategy has failed, your broken mindset will never allow you to cut that trade, leading you to believe that you should exit once it returns to the entry price, exit once it recovers some of the loss, and so on.

- And this is core human nature, and there are special reasons for it; you cannot become a great trader using regular psychology. You must become a wolf on the market.

Psychological Pitfalls in Trading

1. Fear and Greed:

- dread is one of the causes of bad trades; dread takes over decision-making abilities, causing hesitancy in entering at the correct point even when the setup is operating perfectly. Hesitation leads to a missed chance.Even if you enter, fear will cause you to exit prematurely.

- On the other hand, greed causes you to overtrade, converting winnings to losses, and it causes you to cling on to losing positions even when the setup is against you, increasing your risk in trading.

2. Overconfidence:

- As a new trader, after a few successful transactions, your confidence will be high, leading to overtrading and an increased risk of loss.

- Illusion of control is the belief that you have more control over a situation than is actually true. In this case, you will assume you have cracked the trade code and become trapped in the misconception, resulting in further losses.

3. Confirmation Bias:

- Traders do not always see reality and prefer to see what they believe. They come to trade with a fixed attitude, which results in massive losses.

- It is quite risky to not see reality, and live in your own world while dealing with finances is insane.

4. Loss Aversion:

- Traders take a position and decide whether to profit or lose, which results in the instrument being held for too long. In options trading, if you hold a contract for longer than necessary, the premium will decay and you will incur an absolute loss.

- A trader should not trade with a fixed attitude, or at least cut it off when a trend goes against them.

- Not losing capital is market gain.

Importance of Discipline and Patience in Trading

1. Create a Trading Plan:

Having a plan is critical in the trading process. Plans keep you on track, and sticking to them reduces departure significantly. Plan includes short- and long-term goals, the number of trades per day, the day’s loss limit, the profit target, and so on. Sticking to the plan is much more difficult than formulating the plan, and it requires discipline.

Having discipline can assist traders avoid making emotional decisions.

2. Power of Patience:

Taking a position and taking a position at the correct time mean quite different things. The correct trading strategy is to be patient and wait for the perfect opportunity. Experts recommend waiting for the proper chance before taking a position.

How to Control Emotions in Trading?

1. Mindfulness and Meditation:

- Being vigilant and mindful while trading will put your mind at ease because you won’t miss anything. Staying calm and studying everything like an Eagle is the key to maintaining emotional control while trading. Observe every stride you take while in this stance.

- If you are already in the position, you must remain cool and study the market, and be prepared to exit if it reaches your stop loss. We recommend cutting your finger before it becomes too big and then asking for the entire arm. To maintain that peace and mindfulness, you must practice meditation on a daily basis. It’s all about remaining cool and avoiding rush. You will advance as a successful trader.

2. Maintaining a Journal:

Maintaining a journal is usually a good approach for a trader to track their progress. You must write all of the reasons for entering the trade, as well as the reasons for exiting it. By comparing the diary to the real outcome, you will be able to see the faults you are doing when trading.

It will keep track of your mistakes and correct judgments, allowing you to steadily reduce them over time.

3. Have rules and limits:

- Have strict rules while trading in that you should have predefined entry and exit points. If you are planning to take a prior entry or exit, the exact reason should be mentioned which would help in the future.

- Limits should be defined before trading on percentage of profit booking. There should be a limit of maximum trades per day, Limit on losses.

4. Have Breaks regularly:

- You must step away from the screen a few times while trading. It will give us a clear mind and wont let us go through burnout and emotional fatigue.

Build mindset in the long term process

1. Focus on the process:

- Focus on the process by being consistent and trade execution over the time. Sticking to a strategy and working on it again and again works like magic.

- Having a process oriented mindset will lead to long term success.

2. Learn from losses:

- As discussed earlier we need to track our trades and write every reason behind the trade. Once you start doing that you can see the journal and start learning from the losses. We say that there are no bigger teachers than losses if you start learning from them.

3. Being tough and continuous learning:

- As a trader you must understand that you have to be tough as well as ready to learn. If you show your weakness, the market is going to crush you.

Conclusion

Having a clear head and staying calm is essential when learning in the market. Being attentive and resilient in the market is critical for maintaining psychological balance and keeping up with the market. Meditation promotes serenity, which leads to a better end.Discipline and patience are essential for effective trading, as is keeping a journal to learn from the experience.

you may be interested in ths blog here:-

What is the Contrast Between Favored Stock and Normal Stock?

Day Trading Guide for August 7, 2024: Intraday supports, resistances for Nifty50 stocks