Investing in the stock market is about more than just numbers, charts, and analysis; it’s also about psychology. The emotional and cognitive elements that influence an investor’s decision-making can have a significant impact on their success or failure. Understanding investment psychology enables traders and investors to avoid mistakes, remain reasonable, and achieve their long-term financial objectives. This blog digs at the major psychological ideas that influence stock market investors, as well as solutions for overcoming typical biases and emotional barriers.

1. Emotions and the Stock Market

The stock market is a breeding ground for emotional decision-making due to its inherent volatility. Two primary emotions dominate investor behavior:

- Greed: The desire for more profit often pushes investors to take unnecessary risks or hold onto assets for too long.

- Fear: The fear of loss can lead to panic selling or avoiding investment opportunities altogether.

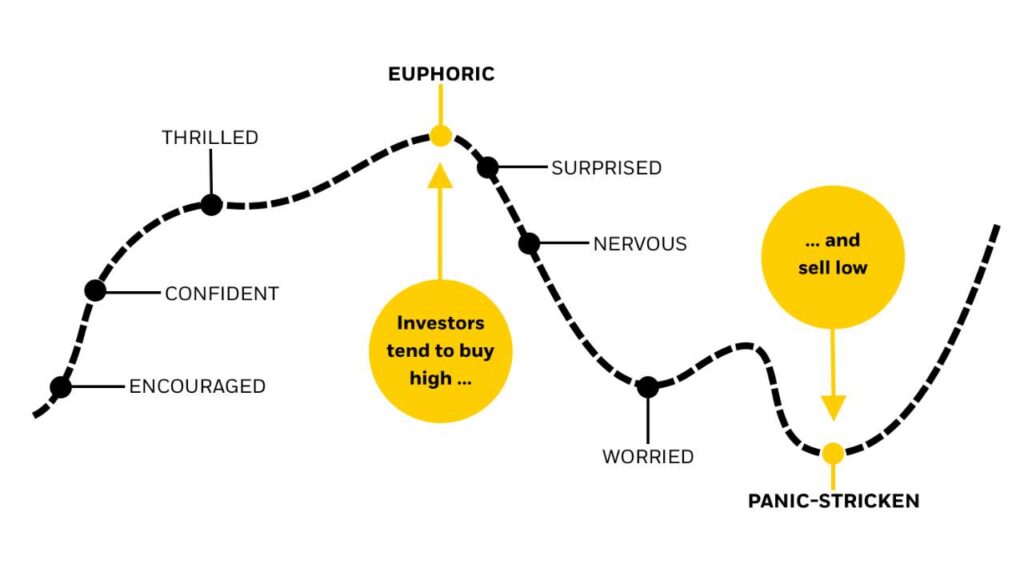

These emotions often lead to irrational decisions, such as buying at market peaks or selling during downturns, which contradict the classic “buy low, sell high” strategy.

2. Behavioral Biases in Investing

Behavioral biases are systematic errors in thinking that can cloud judgment and lead to suboptimal decisions. Key biases include:

- Overconfidence Bias:

Investors often overestimate their knowledge or ability to predict market movements. This can result in excessive trading or risky bets. - Herd Mentality:

The tendency to follow the crowd can lead investors to join market trends without proper analysis, often buying at inflated prices or selling during panic. - Loss Aversion:

People fear losses more than they value gains of the same magnitude. This can lead to holding onto losing stocks for too long or selling winners prematurely. - Anchoring Bias:

Investors fixate on specific information, such as a stock’s initial price, even when new information makes it irrelevant. - Confirmation Bias:

Investors often seek out information that supports their existing beliefs while ignoring contradictory evidence.

3. The Role of Market Sentiment

Market sentiment reflects the collective mood of investors and can drive prices irrespective of fundamentals.

- Bull Markets: Optimism often reigns, leading to aggressive buying and inflated valuations.

- Bear Markets: Fear and pessimism dominate, causing widespread selling and undervaluation.

Understanding and resisting the influence of market sentiment is key to maintaining a balanced approach.

4. Cognitive Dissonance in Investing

Cognitive dissonance occurs when investors are mentally uncomfortable because they possess opposing thoughts or knowledge. For example, holding onto a losing investment because selling would imply admitting a mistake can result in illogical conduct.

5. The Importance of Patience and Discipline

One of the greatest challenges in investing is maintaining patience and discipline. Impulsive decisions driven by short-term market fluctuations often lead to underperformance.

Key habits to cultivate:

- Stick to Your Plan: Develop a well-researched investment strategy and follow it consistently.

- Avoid Impulse Trades: Take time to analyze opportunities rather than reacting emotionally.

- Think Long-Term: Focus on your financial goals rather than daily market noise.

6. Strategies to Overcome Psychological Barriers

a) Set Clear Goals

Define your investment objectives—whether it’s wealth creation, retirement, or passive income—and align your strategies accordingly.

b) Educate Yourself

Knowledge reduces fear and uncertainty. Understand market fundamentals, investment vehicles, and economic trends to make informed decisions.

c) Diversify Investments

Spreading your investments across asset classes reduces risk and minimizes the emotional impact of losses in any one area.

d) Adopt a Systematic Approach

- Use systematic investment plans (SIPs) or dollar-cost averaging to reduce the emotional burden of timing the market.

- Automate investments to avoid impulsive decisions.

e) Practice Mindfulness

Stay present and avoid letting emotions from past losses or future fears influence your decisions.

f) Consult Professionals

Seeking advice from financial advisors or mentors can provide an objective perspective and reduce emotional decision-making.

7. Learning from the Greats

Prominent investors such as Warren Buffett and Peter Lynch stress the significance of emotional stability and logic in investing. Buffett’s counsel, “Be fearful when others are greedy, and greedy when others are fearful,” emphasizes the need of opposing viewpoints and emotional distance.

8. Technology and Investor Psychology

With the rise of mobile trading apps and algorithmic trading, access to markets has never been easier. However, the convenience comes with its own challenges:

- Frequent notifications can lead to overtrading.

- Watching live price movements may exacerbate stress and emotional reactions.

Use technology wisely to avoid falling into psychological traps.

9. Case Studies

Dot-Com Bubble (1995-2000):

Greed and herd mentality pushed tech stock values to unsustainable peaks. When the boom broke, many investors incurred enormous losses.

2008 Financial Crisis:

Fear prompted widespread panic selling, including among long-term investors, resulting in significant asset erosion. Those that remained involved finally profited from the rebound.

10. Building a Resilient Investor Mindset

Resilience is the ability to remain calm and focused despite market volatility. Key steps include:

- Focus on the Big Picture: Consider market trends over decades, not days.

- Celebrate Small Wins: Recognize your financial progress, even if it is small.

- Learn from Mistakes: View every failure as an opportunity to improve your plan.

Conclusion

Investing in the stock market is both a psychological and financial game. Emotions, prejudices, and cognitive obstacles can all derail even the best-planned methods. By understanding and regulating these psychological elements, investors can make more informed decisions, minimize stress, and eventually achieve their financial objectives. Mastering the psychology of investing does not occur immediately. It involves self-awareness, discipline, and a dedication to lifelong learning. With the correct mindset and strategy, anyone can successfully navigate the stock market’s complexity.

you may be interested in ths blog here:-

What is the Contrast Between Favored Stock and Normal Stock?

Day Trading Guide for August 7, 2024: Intraday supports, resistances for Nifty50 stocks