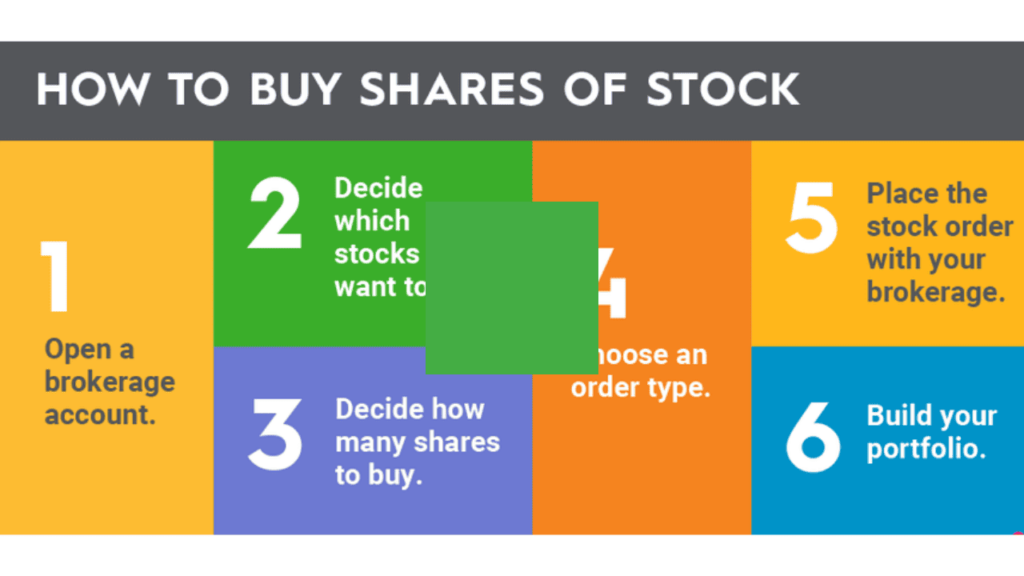

Do you want to get started with stock investing to build your wealth? Here’s what you need to do

Key Points

- Open a brokerage account to start buying stocks.

- Choose stocks with a long-term growth perspective and diversify.

- Decide on the number of shares and select an appropriate order type.

So, you’ve decided to invest in the stock market. You even have some ideas about which stocks you want to buy. But how do you actually buy shares of your favorite companies?

How do you actually buy shares of stock?

Fortunately, the process of buying your first shares of stock online is relatively quick and easy.

- First, you’ll need to open a brokerage account.

- Next, you’ll need to decide which stocks you’d like to buy.

- After you’ve picked your stock(s), you’ll need to determine how many shares you want to buy.

- You’ll then decide which type of stock order is best. Typically, this means either a market or a limit order.

- Finally, you’ll enter your order, hit the buy button, and become a shareholder.

Here’s a step-by-step guide to start your stock investing journey.

1. Open a brokerage account

First, you’ll need an investing account known as a brokerage account to buy stock. Consider two main factors when selecting an online stock brokerage:

- What the brokerage offers: Does your brokerage offer every product and service you need? Some brokerages publish excellent educational resources for new investors. Others provide access to stock research and analytical tools. Some online brokerages maintain branches where you can receive guidance in person. Perhaps other features, such as the ability to trade international stocks or buy fractional shares, are important to you. Of course, some investors simply want an easy-to-use app to buy and sell stocks.

- The user-friendliness of the brokerage platform: Is the brokerage platform easy to navigate? If you want to trade using your mobile device, the brokerage’s mobile interface must be easy to use. Many of the largest brokerages allow you to use play money to experience their trading platforms before you invest, so try a few to decide which platform you like most.

- However, some types of investments, such as mutual funds and options, still often have commissions. Recently, some brokers have started to eliminate these commissions as well, so keep this in mind if you plan on incorporating either into your strategy.

- Once you’ve chosen a brokerage, you must complete a new investment account application. This is typically quick and easy, but you’ll need to have certain information handy, such as a driver’s license and Social Security number.

- You’ll also need your bank account information if you want to fund your new brokerage account using your checking or savings account. You can choose to open a standard brokerage account or establish an individual retirement account (IRA), which comes with some pretty nice tax advantages.

- Another decision you may face is whether to establish margin privilege for your new investment account. Having margin privilege enables you to buy stocks with money borrowed from your brokerage.

- To be clear, investing on margin is generally not a good idea for most investors. However, establishing margin privilege can confer some other benefits. For example, if you have margin privilege, you can typically begin trading in your investment account before your deposited funds have cleared. Margin privilege can also allow you to quickly withdraw money if you need it without selling stocks in your account and waiting for the trade to settle.

2. Decide which stocks you want to buy

In this article, we won’t go too deep into the many possible methods of researching and selecting individual stocks to buy. However, the next step is to determine which stocks you’d like to purchase. Here are a couple of pointers:

- Follow a buy-and-hold strategy: Buy stocks because you believe their underlying businesses will be worth more in a few years than they are today. Don’t buy a stock just because you think it will perform well over the next few weeks or months. And day trading — buying and selling a stock on the same day — is best left to the professionals.

- Diversify your holdings: Don’t put all your money into just one or two stocks. Even if you’re investing only a relatively small amount of money to start, diversify your portfolio by buying a few shares of several different stocks. With commission-free trading, owning the stocks of many different companies does not incur any additional expense. Plus, many brokers offer fractional share investing, which allows you to buy shares of several companies with a relatively small amount of money.

Learn more about how to choose which stocks to buy by checking out our comprehensive guide to investing in the stock market. Or check out some of the top stocks to buy right now if you need some inspiration.

3. Decide how many shares to buy

- To determine how many shares you should buy, first decide how much money you want to invest in each stock that interests you and then divide this amount by the stock’s current share price. You can find stock prices on your brokerage’s platform by searching for either the stock’s ticker symbol or the company’s name.

- Some brokerages allow you to buy or sell fractional shares. If your brokerage trades fractional shares, you can purchase any dollar amount of a stock regardless of its share price. If your broker doesn’t, you must round down to the nearest whole number of shares to determine how many you can buy.

- With fractional shares, it’s possible to create a diversified stock portfolio, even if you only have a few hundred dollars (or even less) to start with.

4. Choose an order type

- Different order types exist for stock purchases. The type of order you place to buy stock specifies the conditions under which you want your broker to complete your transaction. A market order — which instructs your broker to buy the stock immediately and at the best available price — is typically the best order type for buy-and-hold investors.

- On the other hand, you may want to place a limit order. This indicates to your broker the maximum price you’re willing to pay for a stock. For example, let’s say a stock is currently trading for $20.50 per share. You want to buy it only when the price is less than $20, so you place a limit order. Your broker then buys shares on your behalf only if the stock’s price dips below $20.

5. Place the stock order with your brokerage

- To place a stock order, go to the appropriate section of your online broker’s platform and enter the required information. Your brokerage typically asks for the company name or stock ticker and whether you want to buy or sell shares. You’ll also enter either the dollar amount you want to spend or the number of shares you want to buy.

- After you tap the “place order” button, your stock purchase should be executed in seconds (if you’ve made a market order). Your portfolio should immediately update to reflect your ownership of the newly purchased shares. If you place a limit order, the order will only execute when the stock price is less than or equal to the limit price you’ve set.

6. Build your portfolio

- The final step in this process is to build out your investment portfolio. Now that you have a brokerage account and know the basics of buying and selling stocks, you can keep adding money to your brokerage account and investing in stocks you’d like to own for years to come.

- As a final thought, it can be tempting to monitor the performance of your stocks every day (especially at first). However, it’s important to maintain a long-term mindset.

- Certainly, you can and should read quarterly reports and subscribe to news alerts. But if your stocks’ prices decline somewhat, don’t sell in a panic. And if your stocks’ prices rise by a few dollars, resist the urge to cash out. The best and easiest way to build wealth over time is to buy shares of great companies and hold them for as long as the companies remain great.

you may be interested in this blog here:-

What’s the difference between Treasury bonds, notes, and bills

Can I Open a Brokerage Account for My Child

What is the Contrast Between Favored Stock and Normal Stock?