Over half of American workers claim they lack the information necessary to choose and manage investments for their retirement plan, despite the fact that news about the stock market and investing is available every day.¹ If you put your investment knowledge in that category, we’ve got a series of helpful videos and articles for you. We can help you learn the fundamentals, starting with how the stock market operates, even if investing and the stock market may utilize terms you’re not familiar with.

If you want to learn Beginner’s Guide to the Stock Market: A Comprehensive Guide

Getting to know the stock market

Understanding the stock market You could be interested in investing in the stock market whether you have some spare cash to spare or you have a retirement savings plan, like an individual retirement account (IRA) or 401(k). Knowing what the market is and how it functions is a smart idea before entering it.

- What’s a stock?

- What’s the stock market?

- What are stock exchanges?

- What’s a broker?

- Why is the stock market important?

1 What’s a stock?

One kind of investment that symbolizes ownership of a business is a stock. The total stock of a firm is divided into shares, each of which represents an equivalent amount of the company.

For instance, let’s imagine you used your own funds to launch your business and now require additional funding to grow. You might obtain that money by obtaining a bank loan or by independently locating private investors. Another option is to go public and issue stock in order to sell a portion of your company. When you go public, the general public will be allowed to buy shares of your stock.

2 What’s the stock market?

The public can purchase shares of stock on the stock market.In many respects, it is identical to any other type of market, like a farmers’ market or grocery shop. A farmers’ market serves as a central venue for a variety of farmers to come together and sell their wares.Consumers are free to browse the market, consider all of the possibilities, and purchase what they desire.

Similar to this, the stock market is a central location where individuals congregate to purchase and sell stocks and other investment vehicles, such mutual funds, which are essentially funds that aggregate a number of equities. However, rather of being a single market, the stock market is composed of several smaller marketplaces, known as stock exchanges

3 What are stock exchanges?

The companies that really make it easier to buy and sell stocks are stock exchanges. Generally speaking, stock that is offered on one exchange is not offered on another. The two main stock exchanges in the US are as follows:

- The New York Stock Exchange

- The NASDAQ (which stands for National Association of Securities Dealers Automated Quotation System, although most people just call it the NASDAQ)

Every stock exchange has an online presence. The majority of exchanges are entirely online and do not have a physical presence, despite the fact that the New York Stock Exchange (NYSE) is well-known for its physical site on Wall Street in New York City.

Find out more: When did the U.S. stock market open for business?

However, it is not possible to just enter the NYSE building on Wall Street, approach the counter, and place an order to purchase ten shares of ABC Company. You must deal with a broker in order to purchase shares.

4 What’s a broker?

Brokers are individuals or companies that can buy and sell stock through the stock exchanges for their clients. If you wanted to buy 10 shares of a company, you’d have to:

- Set up an account with a broker,

- Deposit money into your account, and

- Submit an order to buy 10 shares of the company with the cash in your account.

Your broker would take your order and use your cash to buy the stock you want from someone else who wants to sell the same stock.

You can invest in stocks, bonds, mutual funds, and a variety of other financial products if you have a brokerage account. Generally speaking, you are not allowed to buy in individual stocks if you have a retirement savings account (such as an IRA or 401(k)), but you are permitted to invest in bonds, mutual funds, and other market-available securities.

5 Why is the stock market important?

The stock market helps both businesses and investors by:

- Offering companies a place to raise money to help grow their business and the economy

- Enabling individuals to choose from a wide range of investments and give their retirement savings a chance to grow in value over time

One significant aspect of the economy is the value of the stock market and the number of shares exchanged in a given day. They show how the stock market’s companies are doing, how the public feels about those companies, and how the public feels about different facets of the economy. This is the reason you hear that on a particular day, the stock market is up (usually people feel good about the market) or down (usually people feel awful about the market).

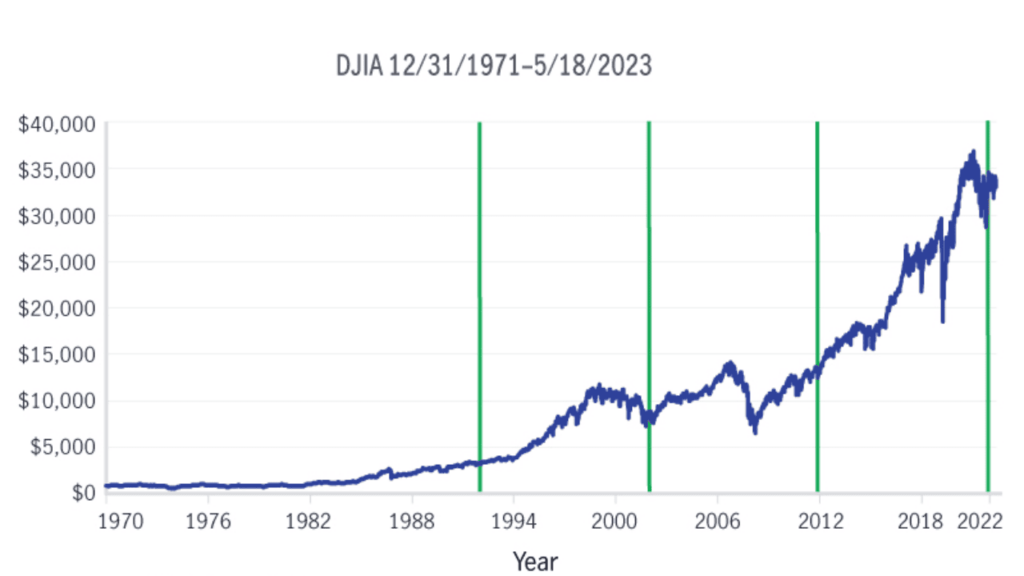

The majority of people utilize a stock market index to make it simple to gauge the success of the stock market. There are a number of well-known indexes that track the value changes of a representative collection of companies, such as the Dow Jones Industrial Average (DJIA), the S&P 500, the NASDAQ Composite, and the NYSE Composite. The total value of the stocks it tracks has increased when the index rises, and the stocks’ value has decreased when the index falls. An index is typically included in news reports that indicate whether the market is up or down.

As you can see below, which uses the DJIA, often known as the Dow, as a gauge of the market’s performance, the value of the stock market tends to increase over time. (The DJIA keeps tabs on 30 of the biggest publicly traded corporations in the nation.) As you can see, market volatility is the term used to describe the significant fluctuations that can occur from day to day or month to month. However, you may also observe that historically, the market’s value has increased over longer time periods.

Despite occasional downturns, the stock market has gone up since 1971

The stock market, investing, and your retirement plan

The stock market provides the average investor with a wide range of investment options. You will have access to stocks, bonds, mutual funds, and a variety of other investment options if you think about opening a brokerage account. You will typically not be allowed to invest in individual stocks if you have a retirement savings plan, such as an IRA or 401(k). Other stock market assets, like mutual funds, bond funds, collective investment trusts, stable value funds, and more, can be available to you depending on the kind of plan you have. To help you expand on what you’ve learned today about investing and the stock market, these investments reflect several asset classes, which are the focus of our upcoming video and article in this series.

you may be interested in this blog here: