Introduction

Bearish Candlestick Patterns are essential for traders aiming to identify potential downtrends and make informed trading decisions. Recognizing these patterns can help you anticipate market reversals and position yourself for potential gains. This article will delve into key bearish candlestick patterns and their significance.

Key Bearish Candlestick Patterns

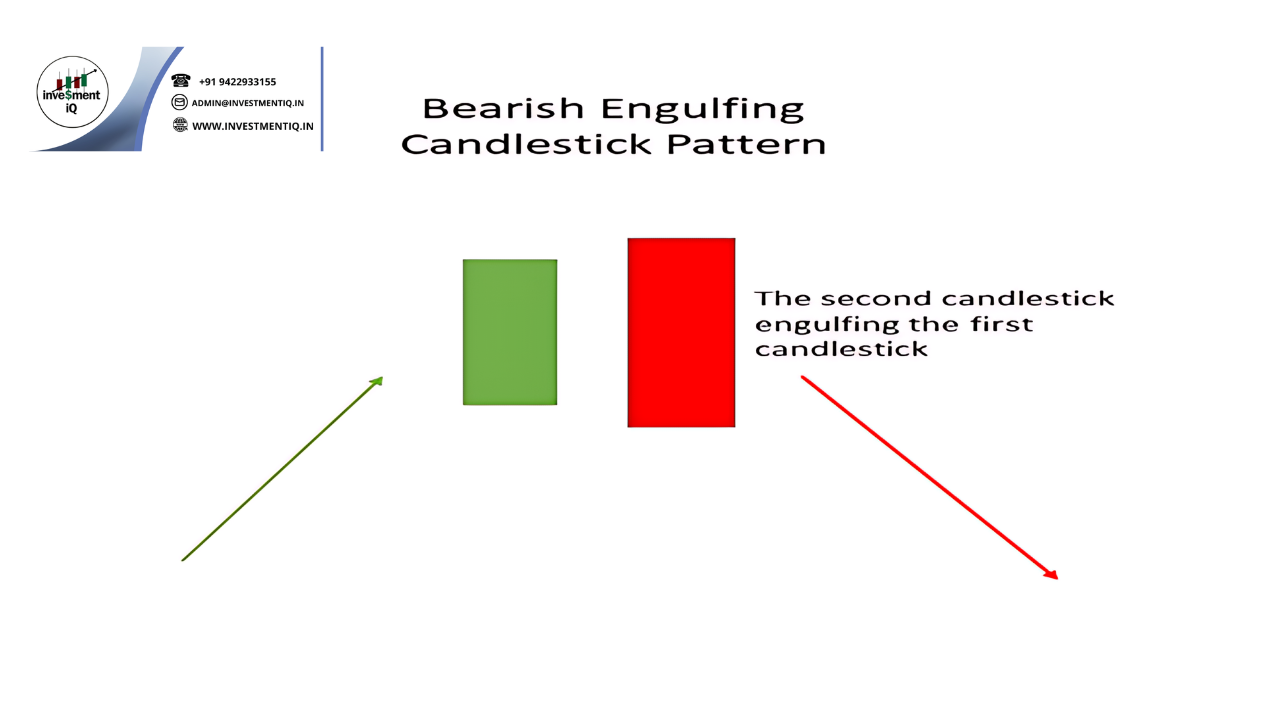

1. Bearish Engulfing Pattern The Bearish Engulfing pattern occurs when a small bullish candlestick is followed by a larger bearish candlestick that engulfs the previous one. This pattern signals a potential reversal from an uptrend to a downtrend.

- Confirmation: Look for confirmation with subsequent bearish candlesticks and volume analysis.

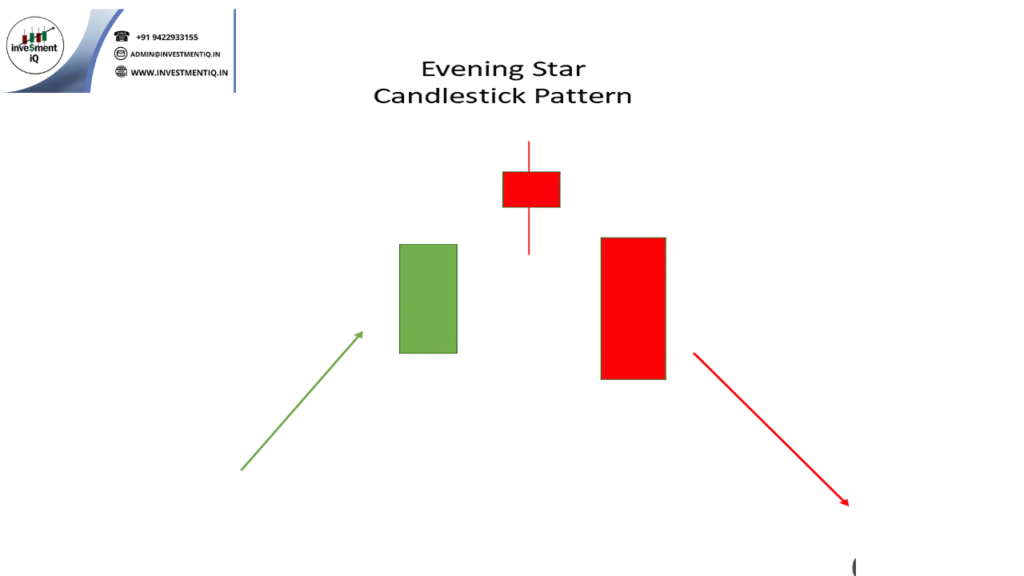

2. Evening Star Pattern The Evening Star pattern is a three-candlestick formation that signals a bearish reversal. It starts with a bullish candlestick, followed by a small-bodied candlestick (the star), and ends with a bearish candlestick.

- Confirmation: Verify with additional bearish confirmation and check for increased volume.

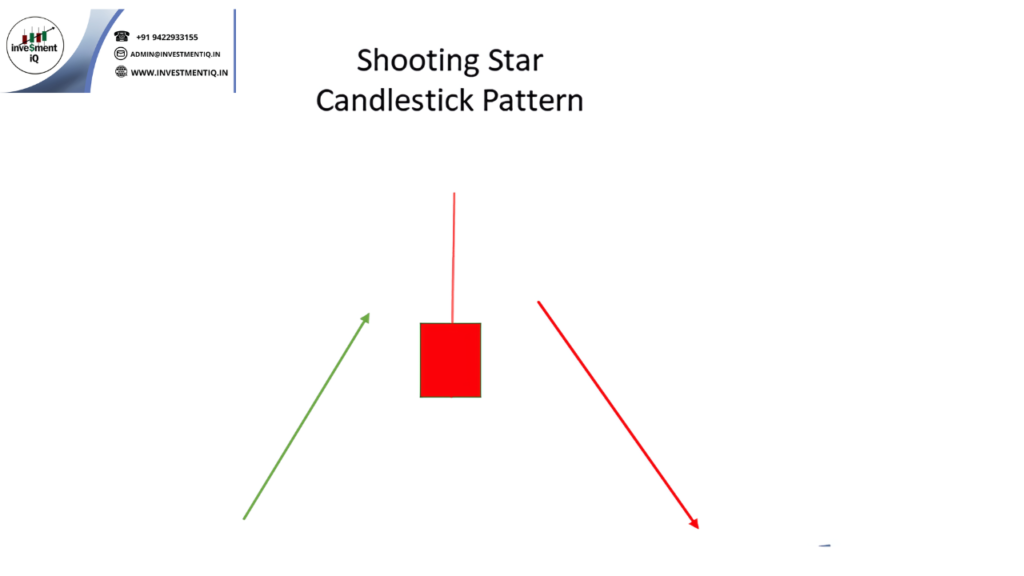

3. Shooting Star Pattern The Shooting Star features a small body at the lower end of the trading range with a long upper wick. It appears after an uptrend and suggests a potential bearish reversal.

- Confirmation: Confirm with subsequent bearish candlesticks and verify with other technical indicators.

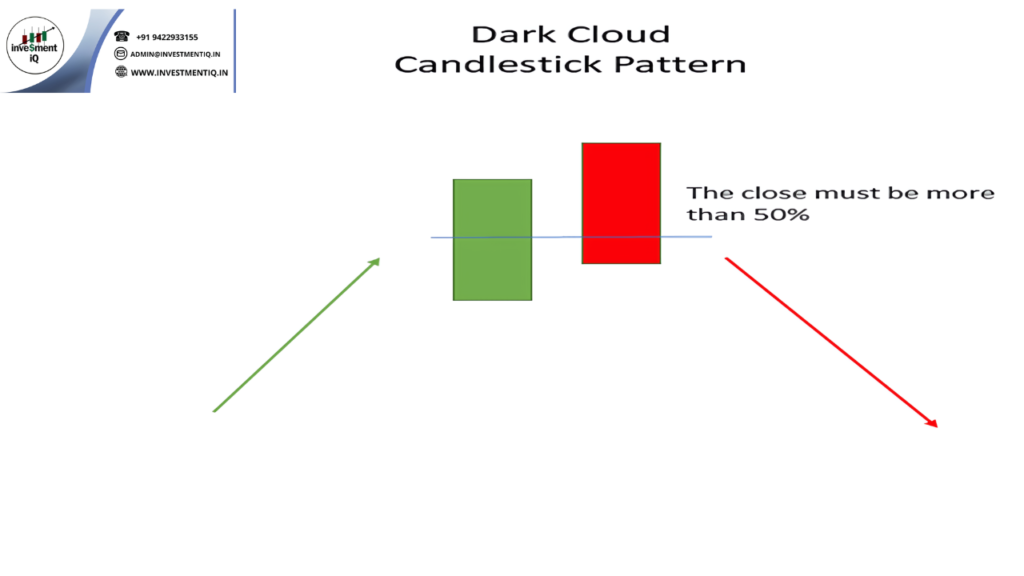

4. Dark Cloud Cover The Dark Cloud Cover pattern occurs when a bullish candlestick is followed by a bearish candlestick that opens above the previous candlestick’s high but closes below its midpoint. This pattern indicates a potential bearish reversal.

- Confirmation: Look for follow-through with additional bearish candlesticks and check for volume increase.

How to Use Bearish Patterns for Trading

Setting Entry Points: Enter a trade after confirming the bearish pattern with subsequent price action and indicators. For example, after spotting a Bearish Engulfing pattern, consider entering when the next candlestick confirms the signal.

Setting Exit Points: Determine exit points based on support levels, profit targets, or trailing stops. Use additional indicators to help set exit strategies.

Risk Management: Implement stop-loss orders to manage risk and protect against unexpected market movements. Adjust your position size based on your risk tolerance and the trade setup.

Conclusion

Identifying bearish candlestick patterns and understanding their implications can greatly enhance your trading strategy. By integrating these patterns with other technical analysis tools and employing effective risk management, you can position yourself to benefit from potential downtrends and improve your trading performance.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis