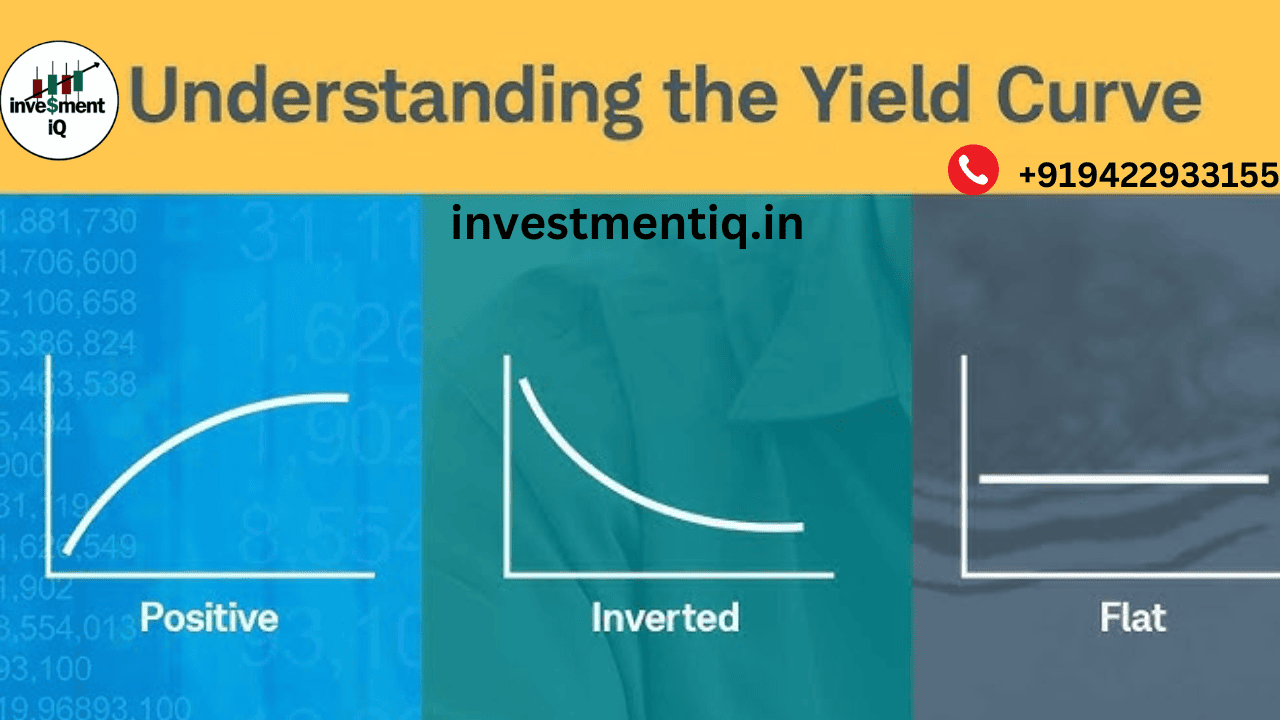

Understanding the Yield Curve

The yield bend is a graphical portrayal of the connection between the financing costs (or yields) of U.S. Depository protections and their developments. Regularly, it has a vertical incline, reflecting more significant returns for longer-term protections contrasted with transient ones. This shape is viewed as ordinary since financial backers request better yields for securing in their cash overstretched periods, making up for gambles with like expansion and vulnerability.

Typical Yield Bend:

Long haul yields are higher than transient yields.

Level Yield Bend:

Short-and long haul yields are almost indistinguishable, demonstrating vulnerability in the economy.

Rearranged Yield Bend:

Transient yields surpass long haul yields, flagging expected financial difficulty.

What Is an Inverted Yield Curve?

A reversed yield bend happens when the financing costs on transient Depository protections transcend those of long haul Depositories. For instance, the yield on a 2-year Depository note could surpass that of a 10-year Depository security.

This reversal challenges the regular financial rationale where long haul speculations convey more serious gamble and subsequently ought to offer better yields. At the point when this abnormality happens, it frequently flags that financial backers are cynical about the close term monetary standpoint.

Why Does the Yield Curve Invert?

National Bank Strategies

The Central bank (Took care of) frequently raises momentary loan costs to battle expansion. This expands the yields on momentary Depositories. In any case, assuming financial backers accept that these climbs will slow the economy or lead to a downturn, they might rush to longer-term Depositories for security, pushing their yields lower.

Financial backer Opinion

At the point when financial backers are worried about monetary development, they incline toward long haul government protections, driving up their interest and bringing down yields.

Monetary Assumptions

In the event that the market expects more slow development or a slump, the interest for longer-term protections expands comparative with momentary ones, prompting a reversal.

Historical Accuracy: Yield Curve as a Recession Predictor

By and large, an upset yield bend has been one of the most dependable marks of a downturn. Throughout the course of recent years, pretty much every U.S. downturn was gone before by a reversal of the yield bend, especially the spread between the 2-year and 10-year Depository yields.

Examples from History

1970s Stagflation

The yield bend rearranged before the 1973-1975 downturn, set off by an oil emergency and inflationary tensions.

2001 Website Air pocket

A rearranged yield bend showed up in 2000, right away before the explosion of the website bubble and resulting downturn.

2008 Worldwide Monetary Emergency

The yield bend rearranged in 2006-2007, well in front of the monetary emergency, precisely flagging the financial slump.

Coronavirus Downturn (2020)

The yield bend rearranged in 2019, foreseeing the downturn that continued in mid 2020, however this was intensified by the pandemic.

How Precise Is the Yield Bend?

The Mechanism: Why Does an Inverted Yield Curve Predict Recessions?

Tightened Credit Conditions

When short-term rates rise, borrowing costs for businesses and consumers increase. This can reduce spending and investment, slowing economic growth.

Pessimistic Market Sentiment

An upset yield bend reflects aggregate financial backer cynicism, flagging that the market expects monetary difficulties ahead.

Are There Alternatives to the Yield Curve

While the yield bend is a powerful marker, it isn’t the main instrument for foreseeing downturns. Financial experts and financial backers additionally consider:

- Driving Monetary Markers (LEI): Measurements like joblessness claims, fabricating movement, and purchaser opinion.

- Corporate Income: Declining benefits frequently go before monetary lulls.

- Real estate Market Patterns: A cooling real estate market can flag more vulnerable financial development.

- Securities exchange Execution: Supported declines can demonstrate basic monetary shortcomings.

Policy Implications

For the Federal Reserve

An upset yield bend frequently constrains the Fed to reexamine its financial arrangements. For example, on the off chance that the Federal Reserve is raising rates forcefully to battle expansion, a reversal could flag that it needs to respite or turn to try not to set off a downturn.

For Policymakers

Government authorities screen the yield bend to survey the requirement for financial intercessions, for example, boost bundles or tax breaks, to seize or relieve a slump.

Criticisms and Debates

Changing Dynamics

Some argue that structural changes in the global economy and financial markets make the yield curve a less reliable predictor today. For example, central bank interventions and quantitative easing have distorted yield movements.

Global Influence

With the U.S. economy deeply interconnected with global markets, external factors like foreign central bank policies and geopolitical events may impact the yield curve without directly correlating to U.S. recessions.

Practical Implications for Investors

- Portfolio Changes

A reversed yield bend frequently prompts financial backers to move toward protective resources, for example, government securities, gold, and profit paying stocks. - Broadening

Financial backers might hope to broaden universally or across resource classes to moderate dangers related with an expected U.S. downturn. - Alert on Hazard Resources

High-risk ventures, like speculative stocks or high return securities, could fail to meet expectations during monetary slumps, making moderate procedures seriously engaging.

The Current Landscape

As of late, the yield bend has caught critical consideration, especially with regards to the Central bank’s fixing cycle to battle expansion. While it altered in late 2022, questions stay about whether this signals another downturn or reflects extraordinary post-pandemic financial circumstances.

Conclusion

The modified yield bend is a strong and generally solid monetary sign, frequently proclaiming downturns with exceptional precision. In any case, it isn’t dependable and should be deciphered inside the more extensive monetary setting. For financial backers, policymakers, and organizations, understanding this pointer is fundamental for exploring possible monetary difficulties and pursuing informed choices.

While the modified yield bend stays a significant device, it ought to be seen close by other financial measurements to portray the economy’s wellbeing. Whether you’re a carefully prepared financial backer or an inquisitive onlooker, the yield bend’s message merits consideration in the present unsure monetary scene.

you may be interested in ths blog here:-

What’s the difference between Treasury bonds, notes, and bills

Can I Open a Brokerage Account for My Child

What is the Contrast Between Favored Stock and Normal Stock?