Intraday Trading Guide for Beginners

Intraday Trading Guide for Beginners: Your First Step to Financial Freedom Introduction Have you ever wondered how some traders make money within a single day? Intraday trading, or day trading,…

Intraday Trading Guide for Beginners: Your First Step to Financial Freedom Introduction Have you ever wondered how some traders make money within a single day? Intraday trading, or day trading,…

What are the Magnificent 7 stocks? The Magnificent 7 stocks are big tech companies. They have large market caps. This means their value is the number of shares times the…

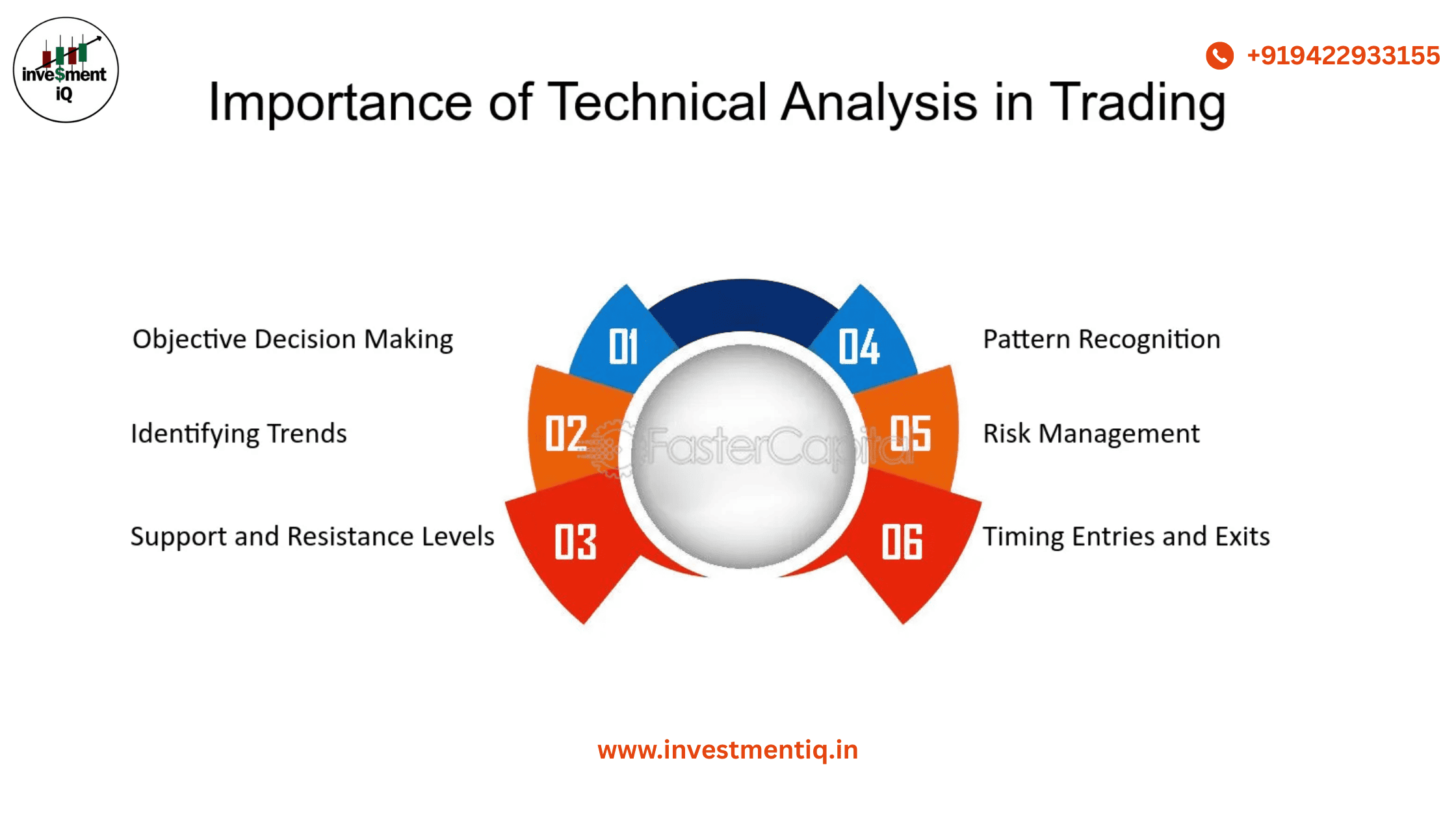

IMPORTANCE OF TECHNICAL ANALYSIS 1. Integration with Other Analysis: We can use technical analysis in addition to fundamental analysis. To refine our entries in fundamentally strong stocks. Example: An investor may…

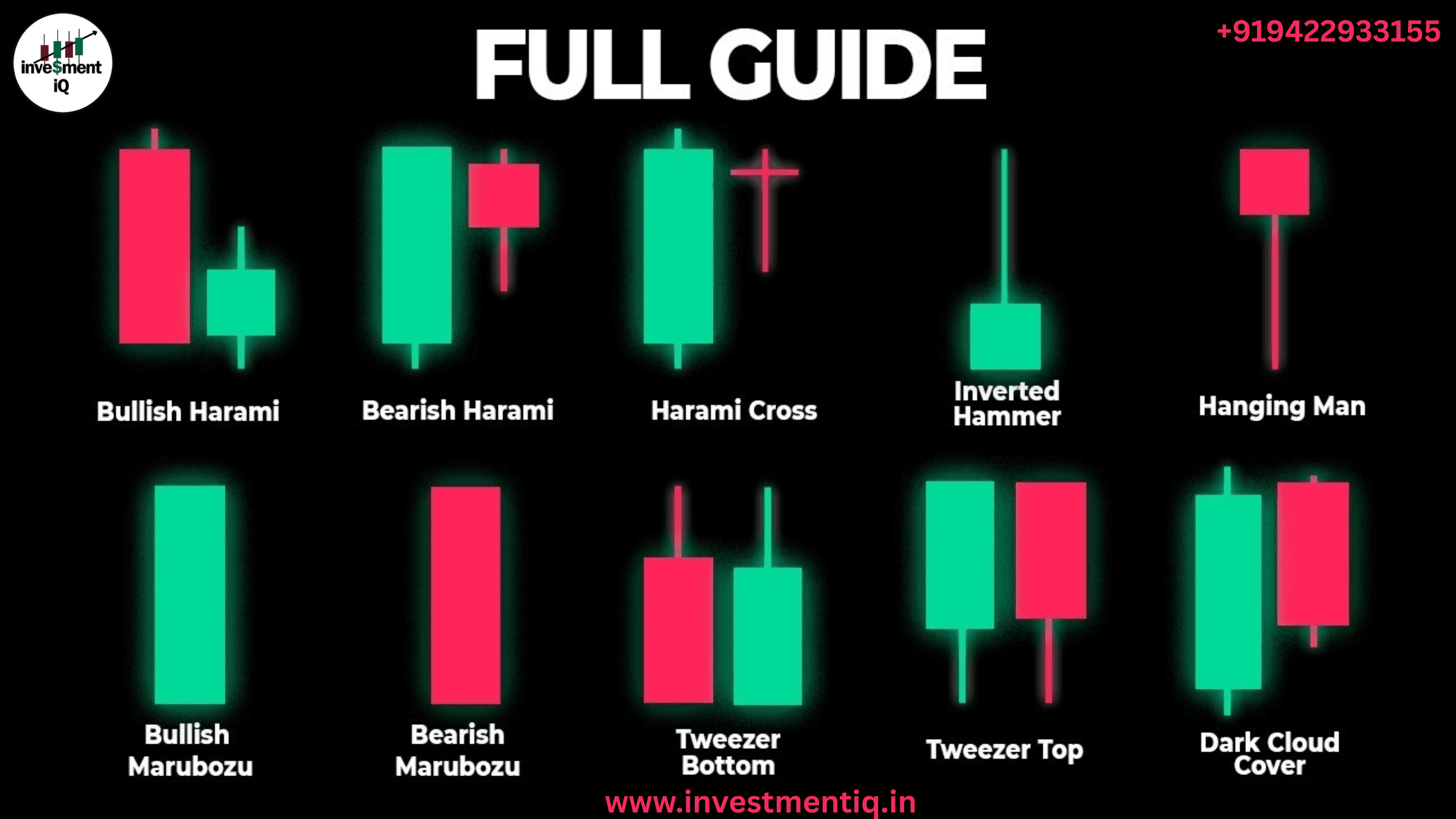

What is Candlestick? Beginners guide to candlestick charts a candlestick is a way of displaying information about an asset’s price movement. Candlestick charts are one of the most popular components…

A Beginner's Guide to Financial Growth: Your Key to Stock Market SuccessWant to invest in the stock market? Not sure where to start?You won't be alone! Many beginners feel lost.…

Choosing the best stocks might be like traversing a maze if you're new to investing. Even though you may be familiar with stocks, shares, and market movements, it might be…

Companies by Market Cap1 to 100 = Large Cap ( More than 50000 cr) 100 to 250 = Mid Cap( 18000 to 50000cr) 251 to End = Small Cap (…

Investing in the stock market is a key strategy for building wealth, and the NIFTY Index has emerged as a significant indicator of the market's health in India. This detailed…

The Stocks Market is the largest and most comprehensive in India. It provides an integrated platform to buy and sell shares, derivatives, mutual funds, and structured products. The platform is built around…

Investors who would rather avoid high-risk bets but still want exposure to equity markets could consider investing in Nifty Index Funds. Having said that, before understanding how to invest in…