Imagine your financial toolbox. Each tool has a specific purpose: to protect your finances. Fixed Deposit (FD) is like a robust toolbox. It keeps your money safe and allows it to grow sustainably, which is worth saving for short-term purposes.

Life insurance is a multi-purpose tool. These provide protection for your loved ones in unexpected circumstances, as well as potential long-term savings benefits. FD and life insurance are both valuable instruments. Yet, they play different roles in creating a secure economic future, giving you multiple options

Term life insurance

Think of a fixed deposit (FD) FD as a piggy bank that raises your money. You put a certain amount of money in it for a certain period of time and the bank promises to give you more money back. This is like your money saying, “Stay here and grow! FDs are the best investment option for short-term savings and safe investments.

Insurance: On the other hand, life insurance is like a safety net for your family. If something happens to you, the insurance company will provide money to help your family in addition to your income. Some life insurance plans, such as long-term piggy banks, also help in saving money from time to time. While the purpose of an

FD is to increase your savings, life insurance primarily provides financial security to yo

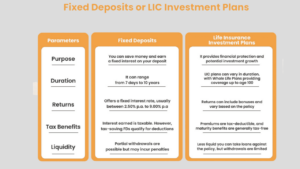

Let’s compare FD and life insurance:

Types of term deposit and life insurance policies

Understanding the different types of FD and life insurance can help you make a more informed decision:

Term Deposit Type:

- Regular FDs: The most common type where you deposit money at a fixed interest rate for a fixed period of time.

- Tax-saving FD: A 5-year FD with tax benefits under Section 80C.

- Senior Citizens FD: People above the age of 60 pay a higher rate of interest.

- Flexi FD: You can withdraw a part of your deposit as and when required.

Types of Life Insurance:

- Term insurance: A term insurance policy provides coverage only if you die during the term of the policy.

- Endowment Plan: Provide both insurance coverage and savings benefits.

- Unit Linked Insurance Plan (ULIP): Collect insurance with market-linked investments. Whole life insurance: It provides coverage for your entire life and not just for a specific period.

- Money back policy: You get regular payouts with insurance cover during the term of the policy.

FD or life insurance plan – which is a better investment?

Deciding between FD and life insurance is not about choosing the “good” option – it is about understanding your needs better. Here’s an easy way to think about it:

Select FD if:

- You want to save money for short-term goals (like buying a car in 2-3 years)

- You prefer guaranteed returns and do not want to take any risk.

- You want easy access to your money.

Choose life insurance if:

- If something happens to you, you want to protect your family financially.

- You are looking for long-term savings with tax benefits.

- You have committed to making regular payments for many years.

Remember, it’s not always one way or the other. Many people use both FDs and life insurance as part of their overall financial planning. While FDs can be great for short-term savings and emergency funds, life insurance provides long-term protection and sometimes additional savings.

Coclusion

Term deposits and life insurance both have their place in good financial planning. FDs provide security and guarantees for short to medium term goals, while life insurance provides significant financial protection for your family and potential long term savings. The best choice depends on your financial goals, risk tolerance and standard of living. Or a combination of the two can often help create a balanced approach to your financial well-being.

Disclaimer: Investment / trading in securities market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss can be significant when trading and investing in the securities market, including equities and derivatives

you may be interested in this blog here:-

What’s the Difference Between Cyclical and Non-Cyclical Stocks?

What’s the Difference Between Cyclical and Non-Cyclical Stocks?