Initial Public Offerings (IPOs) are one of the most exciting events in the financial world, offering investors the chance to buy shares of a private company as it goes public for the first time. While the allure of IPOs can be enticing, they come with their own set of risks and rewards. In this blog, we’ll explore how IPOs work, why companies go public, and how you can invest in them.

What is an Initial public offering?

A First sale of stock (Initial public offering) is the cycle through which a secretly held organization offers its portions to general society interestingly. Thusly, the organization changes from being exclusive to public on a stock trade like the New York Stock Trade (NYSE) or NASDAQ.

The Initial public offering process permits organizations to raise capital by offering offers to countless financial backers. These assets are much of the time used to fuel development, take care of obligation, or put resources into new undertakings. The organization’s portions will be accessible for public exchanging once the Initial public offering is finished, and the cost of those offers not set in stone by the interest on the lookout.

For what reason Do Organizations Open up to the world?

There are a few motivations behind why organizations decide to open up to the world through an Initial public offering:

Raising Capital:

One of the essential reasons an organization opens up to the world is to raise reserves. By giving offers, the organization can produce critical capital that can be utilized to finance extension, innovative work, acquisitions, or other business drives.

Liquidity for Investors:

Initial public offerings give liquidity to early financial backers, pioneers, and workers who hold value in the organization. It permits them to sell their portions and acknowledge benefits from their speculations.

Memorability and Validity:

Opening up to the world can improve an organization’s believability. Being recorded on a significant trade can expand perceivability and give the organization admittance to new business sectors, clients, and providers.

Consolidations and Acquisitions (M&A):

A public organization can involve its stock as cash for acquisitions, permitting it to grow through consolidations or acquisition of different organizations.

Representative Impetuses:

Public organizations can offer investment opportunities or value based pay to draw in and hold gifted workers. This can adjust the interests of workers to the organization’s exhibition.

The Initial public offering Interaction: Bit by bit

The Initial public offering cycle can require a while and includes different advances. Here is a breakdown of the key stages:

Readiness and Choice to Open up to the world

Before an Initial public offering can occur, an organization needs to survey whether it’s prepared for public investigation. This incorporates guaranteeing that monetary records are all together, administration structures are strong, and the organization can follow administrative necessities.

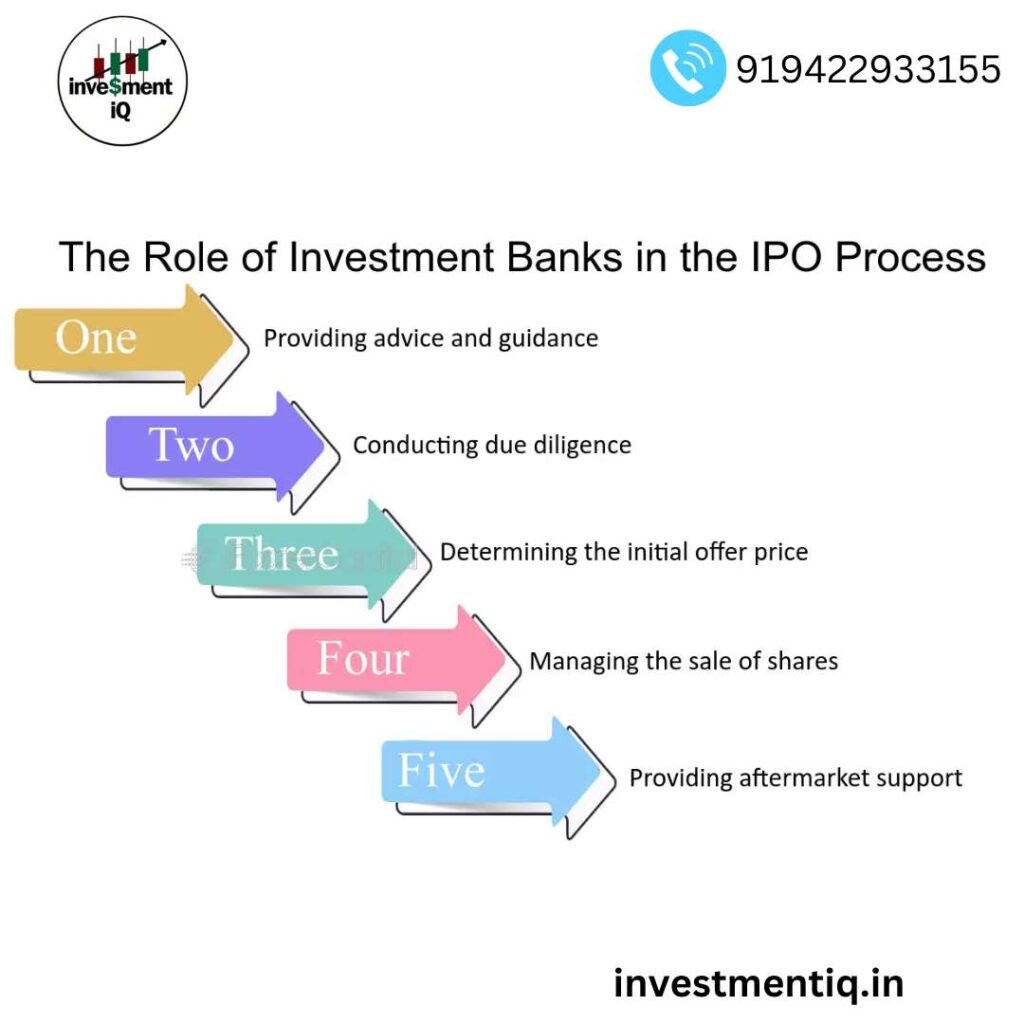

The organization will recruit speculation banks, otherwise called financiers, to direct the Initial public offering process. These guarantors assume a key part in evaluating the offers, promoting the contribution, and guaranteeing that the cycle chugs along as expected.

Recording with the SEC

The subsequent stage includes documenting an enlistment explanation with the Protections and Trade Commission (SEC), an administration office that regulates monetary business sectors. The enlistment articulation incorporates nitty gritty monetary data about the organization, including its income, benefits, misfortunes, and any expected dangers. This report is known as the plan and is made accessible to likely financial backers to provide them with an unmistakable comprehension of the organization’s monetary wellbeing.

Evaluating the Initial public offering

One of the main pieces of the Initial public offering process is evaluating the offers. The guarantors work with the organization to decide a suitable cost in light of elements like economic situations, financial backer interest, and the organization’s monetary presentation. This cost can some of the time be changed during the contribution assuming that request is major areas of strength for especially frail.

The organization will likewise choose the number of offers to offer, which will impact how much capital they expect to raise. The cost and the quantity of offers decide the organization’s all out valuation on the lookout.

Showcasing the Initial public offering (Roadshow)

To produce interest in the Initial public offering, the organization and its financiers will direct a roadshow. During the roadshow, the organization’s leaders travel to meet expected financial backers and present the organization’s story, development possibilities, and speculation potential. The objective of the roadshow is to scrounge up excitement and interest for the contribution.

The Initial public offering Day

Upon the arrival of the Initial public offering, the organization’s portions are authoritatively recorded on the trade, and exchanging starts. The underlying cost of the offers might vacillate in light of market interest. A few Initial public offerings experience critical cost increments on the principal day of exchanging, while others might see their portion cost decline. The underlying cost set by the financiers fills in as a beginning stage, however the genuine market not entirely set in stone by market interest as financial backers trade the offers.

Benefits of Investing in IPOs:

Potential for High Returns: IPOs, particularly those of high-growth companies, can offer substantial returns for early investors. Companies like Google, Facebook, and Amazon generated enormous wealth for investors who bought shares in their early IPOs.

Access to New Investment Opportunities: IPOs provide retail investors with access to stocks that were previously unavailable to the public. This gives you the opportunity to get in on the ground floor of potentially successful companies.

Excitement and Prestige: For some investors, the thrill of participating in an IPO can be a major motivator. Getting in early on an exciting company and being part of its growth can be highly rewarding, both financially and emotionally.

Risks of Investing in IPOs:

Volatility: IPOs are often highly volatile, especially in the first few days or weeks of trading. The price can swing dramatically, and it’s not uncommon for newly listed companies to experience sharp declines in their stock price after the initial surge.

Lack of Track Record: Many companies that go public do not have a long history of being a public entity. This means there may be limited information available to assess their long-term prospects. A lack of historical data can make it difficult to accurately value the company.

Overvaluation: One common risk is that IPOs may be overvalued, especially if there’s a lot of hype surrounding the company. In these cases, the stock price may be inflated, making it harder for investors to earn a profit in the long run.

Underperformance: While some IPOs perform well, many others fail to meet expectations. The post-IPO period can be filled with uncertainty as the company navigates the challenges of being a public entity.

Conclusion

IPOs present an exciting opportunity to invest in emerging companies, but they also come with their own set of challenges and risks. By understanding how IPOs work and conducting thorough research, you can make informed decisions about whether to participate in these high-stakes offerings. While the potential for high returns is real, it’s essential to approach IPOs with caution, especially as market conditions can be volatile. As always, diversify your investments and focus on your long-term financial goals to minimize risks.

you may be interested in ths blog here:-

What is the Contrast Between Favored Stock and Normal Stock?

Day Trading Guide for August 7, 2024: Intraday supports, resistances for Nifty50 stocks