Introduction

The Falling Three Methods patterns is a continuation signal that traders can use to confirm the strength of a downtrend. In this article, we’ll explore the Falling Three Methods pattern, how to identify it, and how traders can use it to confirm trends.

Understanding the Falling Three Methods Pattern

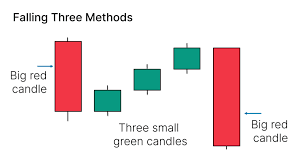

The Falling Three Methods patterns consists of a long bearish candle, followed by three smaller bullish candles, and then another long bearish candle. This pattern indicates that the downtrend is still strong despite temporary buying pressure.

Why the Falling Three Methods Pattern is Important

The Falling Three Methods patterns is significant because it confirms that the downtrend is intact, making it a reliable signal for traders to stay in their short positions or add to them.

How to Identify the Falling Three Methods Pattern

Look for a long bearish candle, followed by three smaller bullish candles that stay within the range of the first candle, and then another long bearish candle. The pattern is more reliable when it appears in a strong downtrend.

Using the Falling Three Methods Pattern in Trading

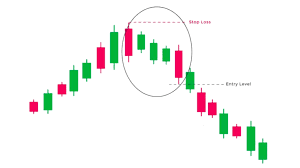

Traders can use the Falling Three Methods patterns as a signal to stay in short positions or add to them, particularly when confirmed by other indicators like volume.

Real-World Examples

Example: A Falling Three Methods patterns formed during a downtrend in a retail stock, confirming the trend’s strength. Traders who recognized this pattern and added to their short positions saw significant gains as the stock continued to fall.

Psychological Aspect

The Falling Three Methods patterns reflects temporary buying within a downtrend, but the overall market sentiment remains bearish.

Limitations

The Falling Three Methods patterns may produce false signals in volatile markets, so it’s essential to confirm with additional analysis.

Conclusion

The Falling Three Methods patterns is a reliable continuation signal for traders looking to confirm the strength of a downtrend. By understanding and using this pattern, traders can make more informed decisions and capitalize on market trends.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis