Introduction

Imagine you’re walking through a dense forest, guided only by the glimmers of sunlight breaking through the canopy. In trading, the Hammer Pattern Explained: A Trader’s Guide is like those glimmers of sunlight, signaling a potential path through the market’s complexities. This guide will help you understand and master the Hammer pattern, enhancing your trading strategies and confidence.

What is the Hammer pattern?

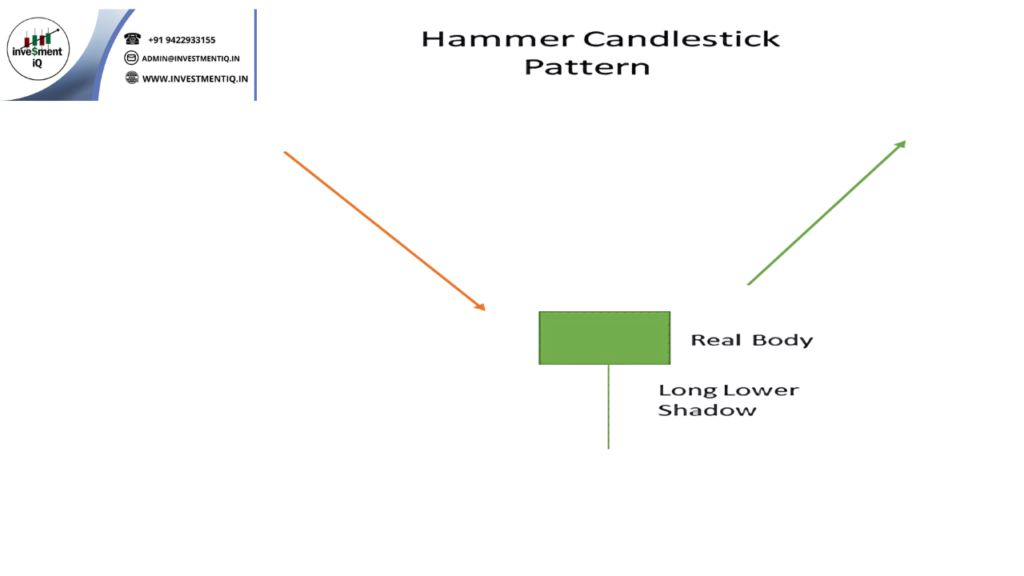

The Hammer pattern is a bullish reversal candlestick pattern that occurs after a downtrend. It’s characterized by a small real body at the upper end of the trading range and a long lower shadow. This pattern suggests that buyers are gaining control, potentially leading to an upward price movement.

Identifying the Hammer pattern

Visualizing the Pattern: Imagine a blacksmith’s hammer striking an anvil. The small body represents the hammer’s head, and the long lower shadow is the handle, indicating that sellers pushed prices down during the trading period, but buyers regained control, closing near the open.

Key Characteristics:

- Small real body at the upper end of the trading range.

- Long lower shadow at least twice the length of the body.

- Little to no upper shadow.

Trading with the Hammer Patterns

Step-by-Step Approach:

- Spot the Patterns: Look for the Hammer patterns at the bottom of a downtrend.

- Confirm with Volume: Higher trading volume on the Hammer day strengthens the pattern’s reliability.

- Use Additional Indicators: Combine the hammer patterns’ with other technical indicators, like RSI or moving averages, for better confirmation.

- Set Entry and Exit Points: Enter a trade when the price moves above the Hammer’s high and set a stop-loss below the pattern’s low to manage risk.

Example Scenario: Imagine a stock that has been declining for several days. Suddenly, you spot a hammer patterns. The next day, the stock opens higher and continues to rise, confirming the pattern. This could be your signal to enter a long position, anticipating further gains.

Conclusion

The Hammer patterns is a powerful tool in a trader’s arsenal, providing clear signals of potential market reversals. By learning to identify and trade this pattern, you can navigate the market with greater confidence and precision.

YOU MAY BE INTERESTED IN THIS BLOG HERE:-

SAP API Hub – Unlock Powerful Integrations | Acme Solutions

Spark Joyful Learning Engaging English Worksheet for UKG Class

SAP for Me: How to Make the Most of Every Business Moment