Introduction

The Hanging Man pattern is a key indicator for traders looking to identify potential market tops. In this article, we’ll explore the Hanging Man pattern, how to identify it, and how traders can use it to spot market peaks.

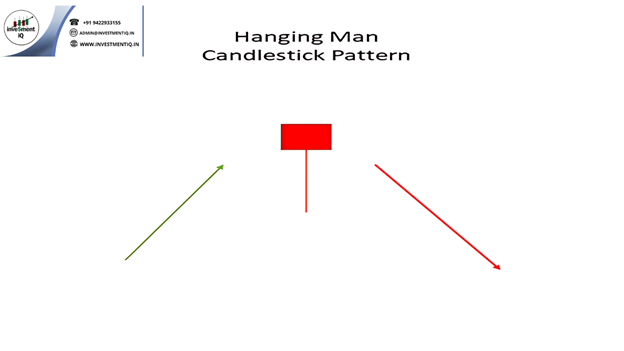

Understanding the Hanging Man Pattern

The Hanging Man patterns consists of a small real body near the top of the trading range, with a long lower shadow and little or no upper shadow. This pattern signals a potential reversal from an uptrend to a downtrend.

Why the Hanging Man Pattern is Important

The Hanging Man patterns is significant because it indicates that selling pressure is increasing, making it a valuable tool for identifying potential market tops.

How to Identify the Hanging Man Pattern

Look for a small real body near the top of the trading range, with a long lower shadow and little or no upper shadow. The pattern is more reliable when it appears after a strong uptrend.

Using the Hanging Man Pattern in Trading

Traders can use the Hanging Man patterns as a signal to exit long positions or enter short positions, particularly when confirmed by other indicators like volume.

Real-World Examples

Example: A Hanging Man patterns appeared at the peak of a tech stock during a market rally, signaling a reversal. Traders who recognized this pattern and exited their positions avoided significant losses as the stock began to decline.

Psychological Aspect

The Hanging Man patterns reflects a shift in market sentiment, with sellers beginning to gain control after a period of buying pressure.

Limitations

The Hanging Man patterns may produce false signals in volatile markets, so it’s essential to confirm with additional analysis.

Conclusion

The Hanging Man patterns is a valuable tool for traders looking to identify potential market tops. By understanding and using this pattern, traders can make more informed decisions and protect their gains.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis