The subsidiaries Derivatives Market is frequently alluded to as the foundation of present day finance because of its amazing size and urgent job in overseeing risk. Regardless of being a critical driver of worldwide monetary action, it remains covered in intricacy, driving numerous to underrate its extension and impact. Anyway, exactly how huge is the subordinates market? How about we plunge into the subtleties.

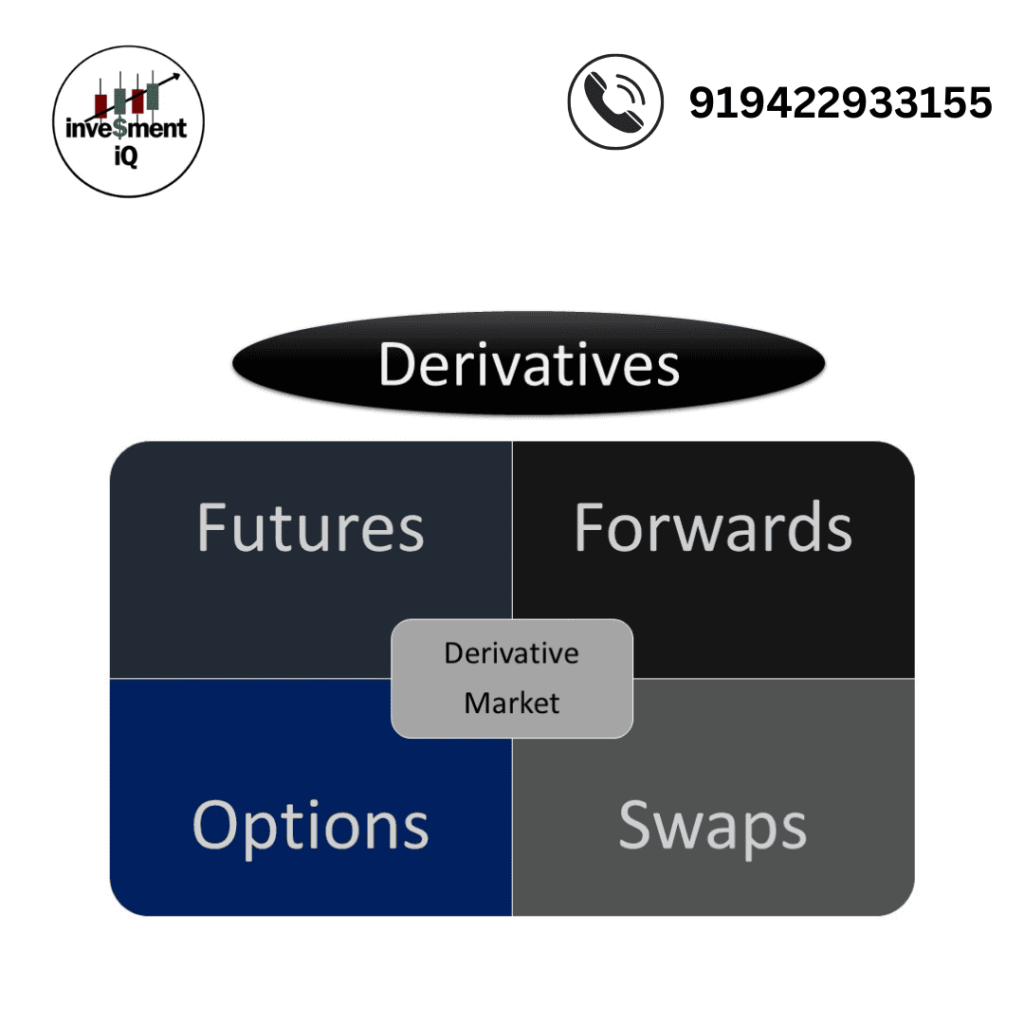

What Are Derivatives?

Derivatives are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, currencies, interest rates, or market indices. The primary purpose of derivatives is to hedge risk or speculate on price movements.

Subordinates are monetary agreements whose worth is gotten from a hidden resource, for example, stocks, securities, products, monetary standards, loan fees, or market records. The main role of subsidiaries is to fence risk or hypothesize on cost developments.

Sorts of Subsidiaries

Fates: Agreements to trade a resource at a foreordained cost on a particular future date.

Choices: Agreements giving the right, yet not the commitment, to trade a resource at a predetermined cost inside a certain time period.

Trades: Arrangements to trade incomes, frequently utilized for loan fee or cash supporting.

Advances: Tweaked agreements to trade a resource at a predetermined cost on a future date.

Understanding the Size of the Derivatives Market

The subsidiaries market is famously challenging to gauge since it works both on controlled trades and over-the-counter (OTC) markets. The notional worth, which addresses the absolute benefit of basic resources, is ordinarily used to measure its size. Be that as it may, this measurement can be deluding on the grounds that it doesn’t mirror the real measure of cash in danger.

Over-the-Counter (OTC) Derivatives

OTC subordinates are tweaked agreements exchanged straightforwardly between parties without mediators. This section is essentially bigger and less straightforward than trade exchanged markets. As per the Bank for Global Settlements (BIS), the notional worth of OTC subsidiaries was roughly $632 trillion as of mid-2023. Nonetheless, a few evaluations propose that while representing all positions, the genuine size of the OTC market could surpass $1 quadrillion.

Breaking Down the Numbers

Notional Value vs. Market Value

Notional Worth:

Mirrors the size of the fundamental resources. For instance, a $100,000 loan fee trade could have a notional worth of $100,000, despite the fact that the genuine openness or income may be a lot more modest.

Market Worth:

Addresses the expense to supplant the agreement at current market rates. This is regularly a lot more modest than the notional worth. For example, the gross market worth of OTC subordinates in 2023 was around $12 trillion, a small portion of the notional worth.

Key Derivatives Categories

- Loan cost Subsidiaries: By a long shot the biggest class, representing almost 80% of the OTC subordinates market, with a notional worth surpassing $500 trillion.

- Unfamiliar Trade Subsidiaries: The second-biggest fragment, esteemed at roughly $100 trillion in notional terms.

- Credit Subsidiaries: Incorporates instruments like credit default trades (Cds), with a notional worth of about $10 trillion.

- Value and Ware Subsidiaries: More modest in correlation yet huge, with consolidated notional qualities in the trillions.

Why is the Derivatives Market So Big?

Supporting and Hazard The executives

Subsidiaries are imperative devices for overseeing monetary gamble. Organizations, banks, and financial backers use them to safeguard against unfavorable developments in loan costs, cash trade rates, and item costs.

Theory

Examiners frequently influence subsidiaries to enhance returns, adding to higher exchanging volumes and market size. The capacity to exchange on edge implies that even limited quantities of capital have some control over enormous positions.

Globalization

The interconnectedness of worldwide business sectors has energized interest for subsidiaries. Worldwide organizations and monetary establishments utilize these instruments to explore complex global dangers.

Advancement and Intricacy

Monetary designing has prompted the formation of progressively complex subsidiaries, like extraordinary choices and organized items. While these instruments offer custom-made arrangements, they likewise add to the market’s size and darkness.

The Role of Central Clearinghouses

To address the risks associated with the OTC market, many derivatives are now cleared through central clearinghouses. These entities act as intermediaries, ensuring that both parties fulfill their contractual obligations. Central clearing reduces counterparty risk and enhances transparency, though it doesn’t capture the entirety of the OTC market.

Risks Associated with the Derivatives Market

Fundamental Gamble

The sheer size of the market implies that disturbances can have expansive outcomes. The 2008 monetary emergency featured the risks of ineffectively grasped subsidiaries, for example, contract upheld protections and credit default trades.

Counterparty Chance

In OTC business sectors, the disappointment of one party to respect an agreement can prompt a fountain of misfortunes. While focal clearing has moderated this gamble, it stays a worry for non-cleared agreements.

Intricacy

The intricacy of subordinates makes them challenging to esteem and direct, expanding the potential for abuse or botch.

Regulation and Oversight

.investmentiq.inIn response to the 2008 financial crisis, regulators introduced measures to improve the transparency and stability of the derivatives market. Key initiatives include:

- The Dodd-Frank Act (USA): Mandates central clearing and reporting of certain derivatives.

- EMIR (Europe): Similar to Dodd-Frank, focusing on risk reduction and transparency in the European market.

- BIS Reporting Standards: The Bank for International Settlements collects and publishes data on global derivatives markets, providing valuable insights.

The Future of the Derivatives Market

The subordinates market is probably going to keep developing, driven by advancement, globalization, and the rising intricacy of monetary business sectors. Key patterns to watch include:

Manageability Connected Subordinates: Devices to support environment related gambles, mirroring the developing significance of ESG (Natural, Social, and Administration) factors.

Blockchain Innovation: The utilization of blockchain could improve straightforwardness and effectiveness in subsidiaries exchanging.

Administrative Advancement: As business sectors develop, controllers should adjust to guarantee dependability without smothering advancement.

Conclusion

The subordinates market is a vital piece of the worldwide monetary framework, with a notional worth that overshadows the size of most different business sectors. While its intricacy and size present difficulties, its part in risk the board and market effectiveness couldn’t possibly be more significant. For policymakers, controllers, and members, the emphasis ought to stay on offsetting advancement with dependability to guarantee the market’s drawn out maintainability.