Introduction

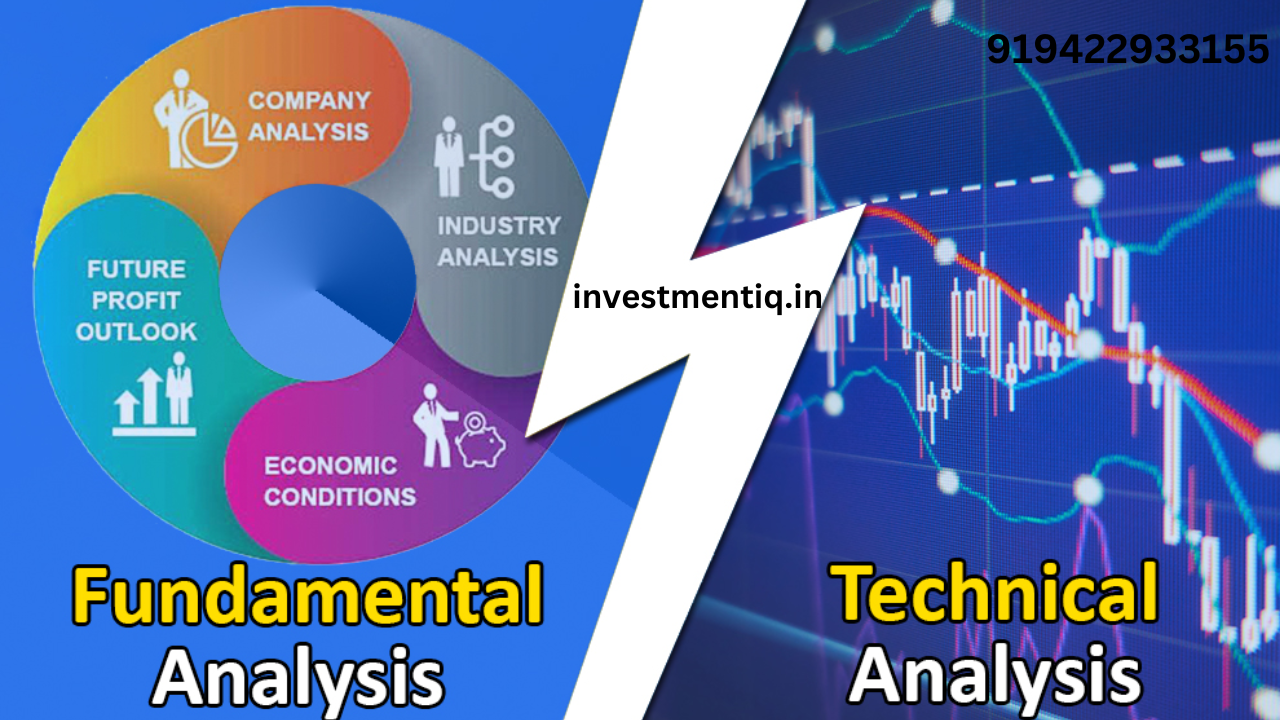

Investigating stocks really is the foundation of effective financial planning. Whether you’re a novice hoping to fabricate your portfolio or an accomplished financial backer meaning to refine your systems, it is pivotal to grasp stock investigation. There are two essential techniques for assessing stocks: Key Examination and Specialized Investigation. Each approach has its assets, procedures, and optimal applications, contingent upon your venture objectives and time skyline.

In this blog, we’ll dig into the distinctions among basic and specialized examination, investigate their key standards, and assist you with figuring out which approach may be the most ideal for your speculation technique.

What is Fundamental Analysis?

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financials, management, industry position, and macroeconomic factors. The goal is to determine whether a stock is undervalued or overvalued based on its true worth.

Key Elements of Fundamental Analysis

Financial Statements:

- Income Statement: Analyzes profitability by examining revenue, expenses, and net income.

- Balance Sheet: Reviews assets, liabilities, and shareholders’ equity to understand a company’s financial health.

- Cash Flow Statement: Tracks the inflow and outflow of cash, indicating how well a company manages its resources.

Key Ratios:

- Price-to-Earnings (P/E) Ratio: Indicates how much investors are willing to pay for each dollar of earnings.

- Price-to-Book (P/B) Ratio: Compares the market value of a stock to its book value.

- Debt-to-Equity Ratio: Measures a company’s financial leverage.

- Return on Equity (ROE): Assesses how efficiently a company generates profits from its equity.

Qualitative Factors:

- Management Team: Leadership quality and decision-making capabilities.

- Industry Position: Competitive advantages, market share, and growth prospects.

- Macroeconomic Trends: Impact of interest rates, inflation, and geopolitical factors.

Benefits of Crucial Investigation

- Ideal for long haul financial backers.

- Gives bits of knowledge into an organization’s general wellbeing and potential for supported development.

- Recognizes underestimated stocks serious areas of strength for with.

Impediments of Essential Investigation

Time-concentrated process.

- Depends on suppositions about future execution.

- May not represent momentary market patterns or opinion.

What is Specialized Examination?

Specialized examination centers around concentrating on cost developments, diagram examples, and exchanging volumes to anticipate future stock way of behaving. It’s an information driven approach that overlooks the characteristic worth of a stock and on second thought depends on verifiable value information and market patterns.

Key Components of Specialized Investigation

Value Diagrams:

- Line Diagrams: Least complex structure, showing shutting costs over the long run.

- Candle Diagrams: Gives point by point bits of knowledge into opening, shutting, high, and low costs inside a particular period.

- Bar Outlines: Like candle graphs yet with an alternate visual portrayal.

Markers and Oscillators:

- Moving Midpoints: Smooth out value information to recognize patterns.

- Relative Strength Record (RSI): Measures force and recognizes overbought or oversold conditions.

- Bollinger Groups: Shows unpredictability and potential cost inversions.

- MACD (Moving Normal Union Disparity): Recognizes pattern strength and inversions.

- Trendlines: Show up, descending, or sideways development.

- Backing and Opposition Levels: Demonstrate costs where stocks will more often than not return quickly or face selling pressure.

- Outline Examples: Head and shoulders, twofold tops, triangles, and so forth.

Benefits of Specialized Examination

Helpful for transient exchanging and recognizing section/leave focuses.

Moderately speedy to learn and apply.

Can be computerized utilizing programming or calculations.

Restrictions of Specialized Examination

Doesn’t think about the central wellbeing of an organization.

Depends on verifiable information, which may not necessarily in every case foresee future developments.

Can be impacted by misleading signs or market commotion.

Comparing Fundamental and Technical Analysis

| Aspect | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Objective | Determine a stock’s intrinsic value. | Predict short-term price movements. |

| Approach | In-depth analysis of financial and qualitative factors. | Focus on price charts and trading patterns. |

| Ideal Time Horizon | Long-term investments. | Short- to medium-term trading. |

| Tools Used | Financial statements, ratios, industry analysis. | Charts, indicators, oscillators, patterns. |

| Data Source | Company reports, economic data, industry trends. | Historical price and volume data. |

| Skill Requirement | Requires deep financial knowledge. | Easier to learn but requires discipline. |

| Risk Level | Lower for long-term investors. | Higher due to market volatility. |

Which Analysis Should You Choose?

When to Utilize Principal Investigation

- You’re a drawn out financial backer zeroed in on creating financial momentum over years.

- You’re keen on understanding an organization’s plan of action, development potential, and upper hand.

- You need to distinguish underestimated stocks and hold them for critical appreciation.

When to Utilize Specialized Investigation

- You’re a merchant searching for momentary open doors.

- You need to gain by value developments and market patterns.

- You’re happy with utilizing graphs and pointers to settle on speedy choices.

Joining The two Methodologies

Numerous effective financial backers utilize a blend of key and specialized investigation. For instance:

- Utilize central examination to distinguish quality stocks for long haul ventures.

- Utilize specialized investigation to decide the best passage and leave focuses for those ventures.

- Normal Missteps to Stay away from

In Key Examination

- Over-dependence on verifiable information disregarding future development possibilities.

- Overlooking industry patterns and macroeconomic elements.

In Specialized Examination

- Utilizing an excessive number of pointers, prompting investigation loss of motion.

- Zeroing in exclusively on diagrams without grasping business sector opinion or news.

Conclusion

Both fundamental and technical analysis are powerful tools for stock analysis, but their effectiveness depends on your investment style, goals, and time horizon. While fundamental analysis helps you identify strong, undervalued companies for long-term growth, technical analysis enables you to optimize your trading strategies by identifying short-term trends and opportunities.

By understanding the principles of both approaches and knowing when to apply them, you can make well-informed decisions and maximize your investment returns. Whether you choose one method or combine the two, continuous learning and disciplined execution are the keys to success in the stock market.

you may be interested in ths blog here:-

What’s the difference between Treasury bonds, notes, and bills

Can I Open a Brokerage Account for My Child

What is the Contrast Between Favored Stock and Normal Stock?