Introduction:

In the realm of candlestick patterns, the Kicking pattern stands out as one of the most potent indicators of market strength. Whether it’s signaling the beginning of a bullish or bearish trend, the Kicking pattern is a clear sign that market sentiment has shifted dramatically. For traders, recognizing this pattern can provide a timely opportunity to enter or exit positions.

Imagine a soccer player gearing up for a powerful kick, sending the ball soaring across the field. The Kicking patterns is much like this decisive moment—a strong indicator that the market is about to make a significant move. In this article, we’ll explore the Kicking pattern, how to identify it, and how to use it as a reliable signal in your trading strategy.

Understanding the Kicking Pattern

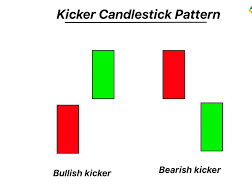

The Kicking patterns is a two-candlestick pattern that signals a sharp reversal in market sentiment. It is characterized by a sudden and strong shift from a bullish to bearish outlook (or vice versa), often resulting in significant price movement.

What Does It Look Like?

- First Candle: A large candlestick, either bullish or bearish, that represents the initial market sentiment.

- Second Candle: A large candlestick of the opposite color, opening with a gap in the opposite direction, signaling a sharp reversal in sentiment.

Why the Kicking Pattern Matters

The Kicking patterns is significant because it represents a decisive change in market sentiment, often leading to a strong trend in the direction of the second candle. This pattern is rare but powerful, making it a valuable tool for traders who can recognize it.

How to Trade the Kicking Pattern

Step 1: Identify the Pattern

To trade the Kicking patterns, start by identifying the first candle, which indicates the initial market sentiment. The second candle, which gaps in the opposite direction, confirms the reversal.

Step 2: Confirm the Reversal

While the Kicking patterns is a strong indicator, it’s important to confirm the reversal with additional technical indicators. For example, a break above a resistance level (in a bullish Kicking pattern) or below a support level (in a bearish Kicking pattern) can provide further confirmation.

Step 3: Plan Your Trade

Once the Kicking patterns is confirmed, consider entering a position in the direction of the second candle. Set a stop-loss below the gap in a bullish scenario or above it in a bearish scenario to manage risk.

Step 4: Monitor the Trade

Given the strength of the Kicking patterns, the market may move quickly. It’s essential to monitor your trade closely and use trailing stops to protect your profits as the trend develops.

Common Mistakes to Avoid

Mistake 1: Misinterpreting Gaps

One common mistake is misinterpreting gaps in the market as Kicking patterns. Ensure that the second candle fully gaps in the opposite direction and is of significant size relative to the first candle.

Mistake 2: Overconfidence in the Pattern

While the Kicking patterns is powerful, it should not be the sole basis for a trade. Always confirm the signal with other technical indicators and consider the broader market context.

The Kicking Pattern in Different Markets

Stocks

In the stock market, the Kicking pattern can signal the start of a strong trend, making it a valuable tool for both swing traders and day traders. It is especially effective when found near key support or resistance levels.

Forex

Forex traders can use the Kicking patterns to identify sudden shifts in currency pair sentiment. Given the impact of economic news on currency prices, the Kicking pattern often appears after significant announcements.

Commodities

In commodities markets, the Kicking pattern may indicate a sharp change in supply-demand dynamics, leading to strong trends. Traders can use this pattern to enter trades with confidence in the direction of the new trend.

Cryptocurrencies

The volatile nature of cryptocurrencies makes the Kicking patterns particularly useful for identifying sudden and strong market moves. However, due to the noise in these markets, it’s essential to confirm the pattern with other indicators.

Conclusion

The Kicking patterns is one of the most potent candlestick patterns, signaling a strong and often rapid change in market sentiment. By understanding how to identify this pattern and incorporating it into your trading strategy, you can enhance your ability to capitalize on significant market moves.

Remember that while the Kicking patterns is a powerful signal, it should be used in conjunction with other technical analysis tools and a thorough understanding of market conditions. With practice and experience, you can master the art of trading with the Kicking pattern, turning market reversals into profitable opportunities.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis