Introduction

The Market Reversals with Hanging Man candlestick pattern is a crucial tool in technical analysis, particularly for identifying potential market reversals. This pattern can signal a shift in market sentiment from bullish to bearish. In this article, we’ll delve into the Hanging Man pattern, its characteristics, and how to use it effectively in your trading strategy. .

Understanding the Hanging Man Pattern

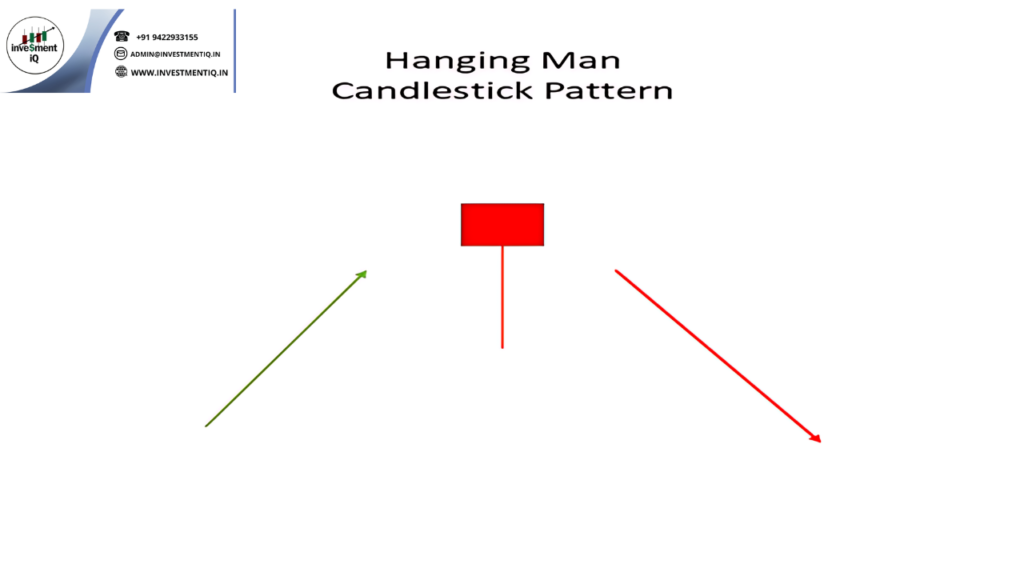

The Hanging Man is a single-candlestick pattern that appears after a strong uptrend. It has the following features:

- Appearance: A small body at the upper end of the trading range with a long lower wick. The upper wick is minimal or nonexistent.

- Significance: The pattern indicates that while buyers have managed to push the price higher, sellers have begun to exert pressure, potentially signaling a bearish reversal.

Key Characteristics:

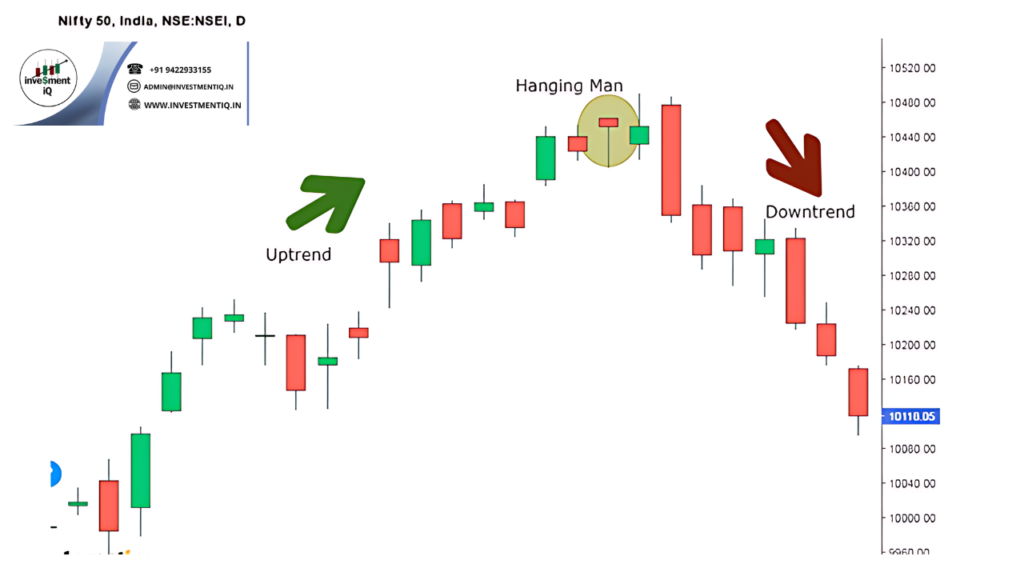

- Location: The pattern appears after an uptrend, suggesting that the trend may be losing momentum.

- Confirmation: The Hanging Man pattern is more reliable when followed by a bearish candlestick that confirms the potential reversal.

How to Identify and Interpret the Hanging Man

Identification:

- Check the Body: The body of the Hanging Man should be small and located at the top of the trading range.

- Examine the Wick: The lower wick should be at least twice the length of the body, indicating that sellers have pushed prices down significantly before the close.

Interpretation Market Reversals with Hanging Man:

- Bearish Reversal Signal: A Hanging Man indicates a potential reversal if confirmed by subsequent bearish candlesticks or technical indicators.

- Volume Analysis: Increased volume on the bearish confirmation candlestick can further validate the reversal signal.

Trading Strategies with the Market Reversals with Hanging Man

Setting Entry Points:

- Bearish Entry: Enter a trade when the price falls below the low of the Hanging Man candlestick, confirming the reversal.

- Confirmation: Ensure that the bearish candlestick following the Hanging Man confirms the signal.

Setting Exit Points:Market Reversals with Hanging Man

- Profit Targets: Set profit targets based on recent support levels or historical lows.

- Stop-Loss Orders: Implement stop-loss orders above the high of the Hanging Man pattern to manage risk.

Risk Management:

- Position Sizing: Adjust your position size based on your risk tolerance and the distance between entry and stop-loss levels.

- Diversification: Combine the Hanging Man pattern with other technical indicators and analysis techniques for a more robust strategy.

Conclusion

The Hanging Man candlestick pattern is a valuable tool for identifying potential bearish reversals after an uptrend. By understanding how to recognize and interpret this pattern, and by integrating it into a well-rounded trading strategy, you can make more informed trading decisions and enhance your overall performance.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis

Ultimate Guide to UKG Math Worksheet PDF Free Download

Advanced OOP Concepts in SAP ABAP A Comprehensive Guide