Introduction

In the fast-paced world of stock trading, understanding Marubozu Pattern candlestick patterns is crucial for making informed decisions. One such powerful pattern is the Marubozu. A Marubozu candlestick can provide strong trading signals, helping traders to identify potential market movements and trends. In this article, we’ll dive into what a Marubozu pattern is, how to recognize it, and how traders can use it to their advantage.

What is a Marubozu Pattern?

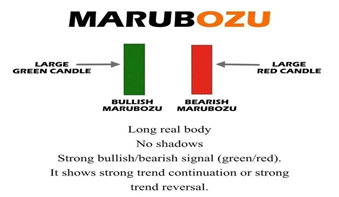

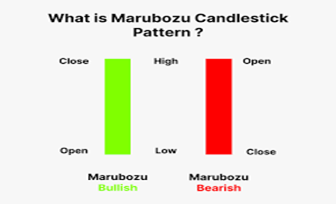

The Marubozu candlestick is unique due to its lack of wicks or shadows, meaning the opening and closing prices are at the candle’s high and low, respectively. This results in a long, solid body that signifies strong momentum in the market, either bullish or bearish.

Types of Marubozu Candles

There are two primary types of Marubozu candles:

- Bullish Marubozu:

- A Bullish Marubozu opens at its low and closes at its high, indicating strong buying pressure.

- This pattern suggests that buyers have controlled the market throughout the session, driving prices upward without any resistance.

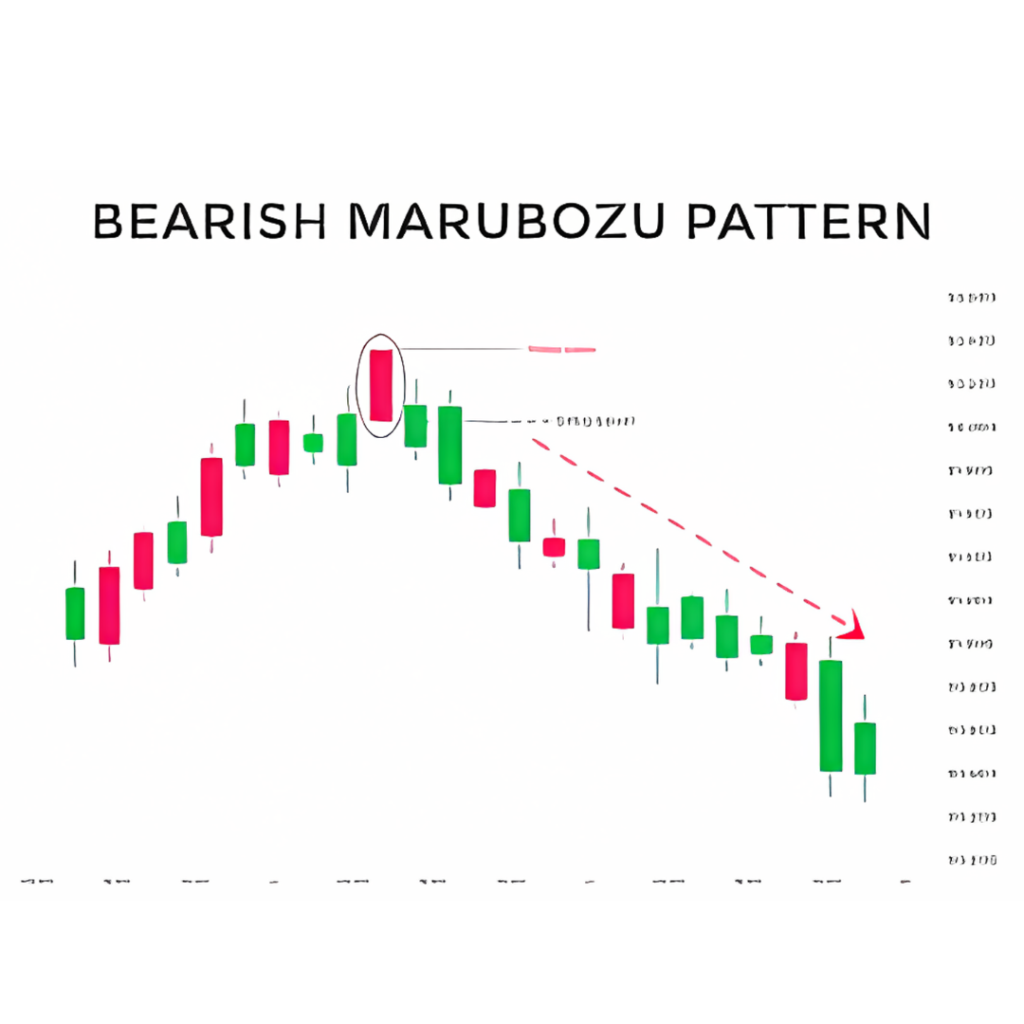

- Bearish Marubozu:

- A Bearish Marubozu opens at its high and closes at its low, indicating strong selling pressure.

- This pattern suggests that sellers dominated the market, pushing prices downward continuously during the session.

Why is the Marubozu Pattern Important?

The Marubozu pattern is important because it reflects strong market sentiment. When a Marubozu appears, it often signals the beginning or continuation of a trend. For instance, a Bullish Marubozu could indicate the start of an uptrend, while a Bearish Marubozu could signal the onset of a downtrend.

Identifying a Marubozu Pattern

Recognizing a Marubozu on a candlestick chart is straightforward:

- Bullish Marubozu: Look for a candle with a long green (or white) body, no upper or lower shadow, and a close higher than the open.

- Bearish Marubozu: Look for a candle with a long red (or black) body, no upper or lower shadow, and a close lower than the open.

These characteristics make the Marubozu easy to spot, even for novice traders.

Using the Marubozu Pattern in Trading

Traders can use the Marubozu pattern in several ways:

- Confirmation of Trends:

- A Marubozu pattern can confirm the strength of an existing trend. For example, if an uptrend is already in place, a Bullish Marubozu suggests the trend will likely continue.

- Reversal Signals:

- While Marubozu candles typically indicate trend continuation, they can also suggest reversals, especially if they appear after a prolonged trend. A Bullish Marubozu following a downtrend might indicate a reversal to the upside.

- Entry and Exit Points:

- Traders often use Marubozu patterns to determine entry and exit points. A Bullish Marubozu might be a signal to enter a long position, while a Bearish Marubozu could suggest it’s time to exit a position.

Real-World Examples

To understand the power of the Marubozu pattern, let’s look at some real-world examples:

- Example 1:

- During a strong uptrend in a tech stock, a Bullish Marubozu appeared, reinforcing the uptrend. Traders who recognized this pattern and went long profited as the stock continued to rise.

- Example 2:

- In a downtrend, a Bearish Marubozu formed, confirming the market’s bearish sentiment. Traders who shorted the stock based on this pattern saw gains as the stock price fell further.

The Psychological Aspect

The Marubozu pattern also reflects market psychology:

- Bullish Marubozu: It shows that buyers are in complete control, with no resistance from sellers. This confidence can lead to further buying pressure.

- Bearish Marubozu: It indicates that sellers dominate, with buyers unable to push prices higher. This lack of buying interest can result in continued selling pressure.

Understanding this psychological aspect can help traders anticipate market movements more accurately.

Limitations of the Marubozu Pattern

While the Marubozu is a powerful tool, it has limitations:

- False Signals: Sometimes, Marubozu patterns can produce false signals, especially in choppy or range-bound markets. Traders should always confirm the pattern with other technical indicators or candlestick patterns.

- Market Context: The effectiveness of the Marubozu pattern can vary depending on the market context. It works best in trending markets but may be less reliable in sideways markets.

Conclusion The Marubozu pattern is a valuable tool for traders looking to capitalize on strong market trends. By understanding and recognizing this pattern, traders can gain insights into market sentiment and make more informed trading decisions. However, as with any trading strategy, it’s essential to use the Marubozu pattern in conjunction with other indicators and market analysis to minimize risk and increase the chances of success.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis

Ultimate Guide to UKG Math Worksheet PDF Free Download

Advanced OOP Concepts in SAP ABAP A Comprehensive Guide

Tags: #Hanging Man Patterns