Introduction

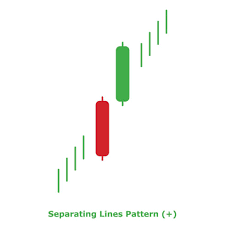

The Separating Lines pattern is a notable candlestick formation that traders use to predict market movements. It often appears as part of a larger trend and can signal potential reversals or continuations. In this guide, we’ll explore the Separating Lines pattern and discuss how to incorporate it into your trading strategies.

What Is the Separating Lines Pattern?

The Separating Lines pattern involves two candlesticks:

- First Candlestick: The initial candlestick is typically a strong bullish or bearish candle, depending on the trend direction.

- Second Candlestick: The following candlestick opens at or near the previous candle’s closing price but moves in the opposite direction, showing a clear separation from the first candlestick’s range.

Key Characteristics:

- Bullish Separating Lines: Occur in a downtrend, with a bearish candlestick followed by a bullish candlestick that opens at or near the previous close but ends higher.

- Bearish Separating Lines: Appear in an uptrend, with a bullish candlestick followed by a bearish candlestick that opens at or near the previous close but ends lower.

How to Identify and Interpret Separating Lines

Bullish Separating Lines:

- Appearance: After a downtrend, the first candlestick is bearish. The second candlestick opens at or near the close of the bearish candle and forms a bullish candle, signaling a potential reversal.

- Confirmation: Look for confirmation from subsequent bullish candlesticks or technical indicators to validate the reversal.

Bearish Separating Lines:

- Appearance: After an uptrend, the first candlestick is bullish. The second candlestick opens at or near the close of the bullish candle and forms a bearish candle, indicating a potential bearish reversal.

- Confirmation: Confirm with additional bearish candlesticks or indicators to support the reversal signal.

Trading Strategies with Separating Lines

Setting Entry Points:

- Bullish Entry: Enter a trade when the second candlestick in a Bullish Separating Lines pattern closes above the high of the first candlestick.

- Bearish Entry: Enter a trade when the second candlestick in a Bearish Separating Lines pattern closes below the low of the first candlestick.

Setting Exit Points:

- Profit Targets: Set profit targets based on resistance or support levels, depending on the direction of the trade.

- Stop-Loss Orders: Implement stop-loss orders to manage risk and protect against adverse price movements.

Risk Management:

- Position Sizing: Adjust your position size based on your risk tolerance and the distance between entry and stop-loss levels.

- Diversification: Avoid placing too much emphasis on a single pattern. Combine the Separating Lines pattern with other indicators and analysis techniques for a more robust strategy.

Conclusion

The Separating Lines pattern can be a valuable tool for traders looking to identify potential market reversals or continuations. By understanding how to recognize and interpret this pattern, and by incorporating it into a comprehensive trading strategy, you can enhance your decision-making process and improve your trading outcomes.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

Salesforce Developer Salary in India An In-Depth Analysis

Ultimate Guide to UKG Math Worksheet PDF Free Download

Advanced OOP Concepts in SAP ABAP A Comprehensive Guide