Minister in this Union Budget 2024?

In anticipation of Budget 2024, different sectors of the economy have different expectations. Individual taxpayers are expecting lower income tax rates, while corporate entities are hoping for an increase in incentive measures to boost investments. Small investors are keen on favourable changes in capital gains taxes and other provisions that will benefit them.

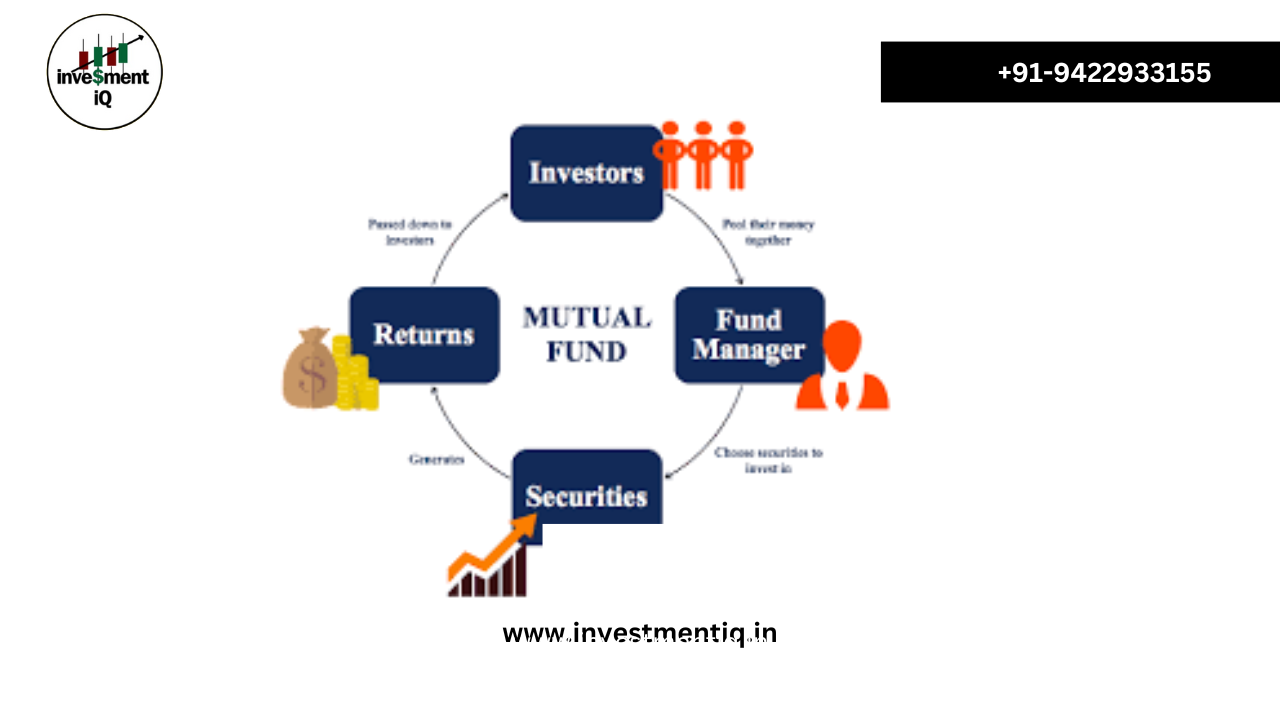

Institutional investors are stressing the importance of fiscal discipline and continuation of stable economic policies. Specifically, mutual fund houses are expecting the government to raise the fiscal deficit target to below 5% and increase the limit of Long Term Capital Gains (LTCG) tax applicability from ₹1 lakh to ₹3 lakh. These measures are seen as crucial to support economic growth and boost investor confidence in the upcoming budget announcement.

A mutual fund industry expert has recommended that the government should consider abolishing the capital gains tax that investors have to pay when they shift their investments from a regular mutual fund scheme to a direct mutual fund scheme.

Budget 2024: Key expectations of the mutual fund industry

(1) Fiscal consolidation

A senior fund manager at Tata Asset Management emphasised the critical importance of maintaining fiscal discipline in the upcoming budget. Fiscal discipline refers to how well the government manages its spending and borrowing to ensure economic stability. It directly impacts several key factors such as domestic liquidity (availability of money in the economy), currency movements (the value of the rupee against other currencies), inflation (the rate of increase in prices of goods and services), interest rates (the cost of borrowing money) and indirectly, the outlook for the equity market.

He said the main focus in the upcoming budget will be on the government’s fiscal deficit targets. The government’s target for FY24-25 is to achieve a fiscal deficit equal to 5.1% of GDP. The target for FY26 is to bring the deficit below 4.5% of GDP. These targets reflect the government’s commitment to prudently manage its finances amid economic priorities and the upcoming elections. Achieving these targets is important to maintain investor confidence and support sustainable economic growth.

(2) Focus on infrastructure and SME sector

Many mutual fund experts believe that the Finance Minister will focus on two main areas in the upcoming budget, including controlling government spending and promoting key sectors such as infrastructure and small businesses. They estimate that the government will set a fiscal deficit target of less than 5%, down from the current 5.1%. There is also likely to be increased support for social welfare in rural areas, with the state contributing resources. Improving infrastructure to address supply chain challenges will be a priority, and efforts are expected to stimulate growth in the SME sector.

(3) Decline in market borrowings

Some experts predict that the government may reduce its borrowing requirements following a bumper dividend payout from the RBI. It is also hoped that tax benefits for middle-income earners will not be reduced and capital gains tax benefits on equities will remain intact. Looking at economic growth, experts suggest that the budget may focus on increased capital expenditure on infrastructure, agriculture and manufacturing to stimulate broad-based growth. Overall, the upcoming budget should aim for a balanced approach to support economic growth and fiscal sustainability.

(4) Incentives for higher capital expenditure by the private sector

The mutual fund industry is hoping for moves that will encourage private companies to increase their spending on building new factories and expanding operations. The performance of the stock market depends on how much money companies earn. These earnings are driven by how much business activity takes place in the country. Despite consistent government policies over many years, we have not seen any major increase in the money private companies spend on new projects. If the government continues to manage money wisely and keep economic policies stable, and if there is strong demand for goods and services, private companies may feel more confident about investing more money to increase their production capacity. This will help them meet future demand for their products.

Final Words

Overall, Budget 2024 is expected to boost economic growth, as well as manage money wisely and instill confidence in investors. It is expected to create conditions where businesses invest more in new projects, especially in sectors such as infrastructure and small businesses. This helps the economy remain stable and growing despite challenges around the world and within the country. It is also expected to keep taxes fair for everyone, encourage more people to invest and help businesses flourish. Overall, it is about striking a balance between boosting growth, keeping finances under control and making investors feel safe, while facing the ongoing changes in the global and local economies.

Disclaimer: Investing/trading in securities market is subject to market risk, past performance is not a guarantee of future performance. Trading and investing in securities markets including equities and derivatives can carry substantial risk of loss.

you may be interested in this blog here:-

Full Stack Development Salary in India – 2024 Trends and Insights

All 35 Candlestick Chart Patterns in the Stock Market-Explained

How to Master the Candlestick Chart

Disclaimer: Investments in the securities market are subject to market risk, read all related documents carefully before investing.