The Price-to-Earnings (P/E) ratio is one of the most commonly used metrics in stock valuation. It serves as a quick snapshot of how much investors are willing to pay for each dollar of earnings generated by a company. While the P/E ratio is a popular tool, understanding what constitutes a “good” P/E ratio is not always straightforward—it depends on various factors, including the industry, market conditions, and growth expectations.

In this blog, we will break down the concept of the P/E ratio, explore its significance, and discuss how to determine whether a stock’s P/E ratio is “good” or not.

What is the P/E Ratio?

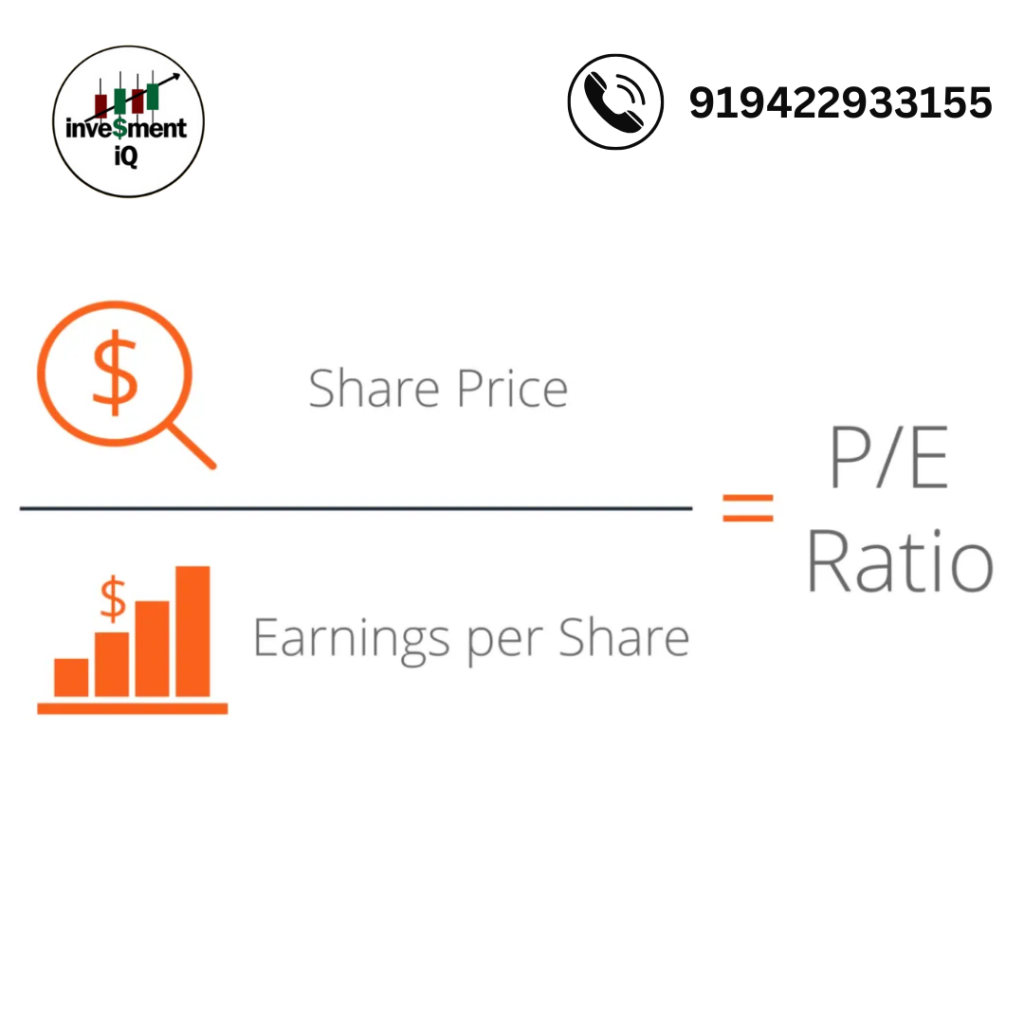

The P/E ratio compares a company’s stock price to its earnings per share (EPS). It is calculated using the following formula:

P/E Ratio = Price per Share / Earnings per Share (EPS)

- Price per Share: The current market price of a single share.

- Earnings per Share (EPS): The company’s net profit divided by the number of outstanding shares.

For example, if a stock is trading at $50 per share and its EPS is $5, the P/E ratio is:

P/E = $50 ÷ $5 = 10

This means investors are willing to pay $10 for every $1 of earnings the company generates.

Why is the P/E Ratio Important?

The P/E ratio is a key metric because it provides insights into the valuation of a stock relative to its earnings. Here’s what the P/E ratio can tell you:

- Investor Sentiment: A high P/E ratio often indicates that investors expect strong future growth. Conversely, a low P/E ratio may signal lower growth expectations or undervaluation.

- Comparative Analysis: It allows investors to compare the valuation of a stock against its peers, the overall market, or its historical averages.

- Risk Assessment: A high P/E ratio may suggest that a stock is overvalued and comes with greater risk, while a low P/E ratio could indicate a bargain or a struggling company.

While useful, the P/E ratio should never be viewed in isolation. It’s crucial to consider other financial metrics and qualitative factors when evaluating a stock.

What is Considered a Good P/E Ratio?

There is no all around “great” P/E proportion, as it fluctuates relying upon a few variables:

Industry Standards

Various ventures have different normal P/E proportions because of changing development rates, benefit, and plans of action. For instance

Innovation Organizations: Will generally have higher P/E proportions (20-50 or more) due to solid development potential.

Service Organizations: Frequently have lower P/E proportions (10-20) in view of stable yet sluggish development.

Economic situations

In a bullish market, P/E proportions across areas may be higher because of financial backer good faith. On the other hand, during bear markets, lower P/E proportions might reflect market negativity.

Development Assumptions

Development stocks regularly have higher P/E proportions as financial backers anticipate huge income development. Conversely, esteem stocks frequently have lower P/E proportions, making them appealing to deal trackers.

Verifiable Midpoints

An organization’s ongoing P/E proportion can measure up to its verifiable normal to survey whether it is exaggerated or underestimated. For example, on the off chance that an organization’s normal P/E proportion is 15 yet it is right now at 25, it very well may be exaggerated.

High P/E Ratio: Is It Always Bad?

A high P/E proportion isn’t really a warning. It frequently reflects high development assumptions for the organization. For instance:

Tech Goliaths: Organizations like Tesla or Amazon frequently have high P/E proportions since financial backers anticipate dramatic development later on.

New or Creative Organizations: New businesses or organizations in arising ventures might have high P/E proportions because of their troublesome potential.

In any case, a high P/E proportion can likewise demonstrate overvaluation, particularly on the off chance that the organization neglects to follow through on its development guarantees.

Low P/E Ratio: Is It Always Good?

A low P/E proportion could appear to be appealing, yet it’s not generally a deal. It can demonstrate:

- Undervaluation: The stock might be undervalued, offering a decent purchasing an open door.

- Horrible showing: The organization may be battling with declining profit, which could prompt further difficulties.

- Financial backers should dissect the organization’s basics to decide if the low P/E proportion is a sign of significant worth or an admonition sign.

Forward P/E vs. Trailing P/E

While breaking down P/E proportions, recognizing the two fundamental types is significant:

Following P/E Proportion:

In light of income from the beyond a year. It gives a verifiable viewpoint yet doesn’t represent future development.

Forward P/E Proportion:

In view of extended income for the following a year. It reflects future assumptions however is dependent upon mistakes in gauges.

The two measurements have their purposes, yet the forward P/E proportion is in many cases more significant for development situated

How to Use the P/E Ratio in Stock Analysis

Analyze Inside A similar Industry

The P/E proportion is most valuable while contrasting organizations inside a similar industry. For instance, on the off chance that one tech organization has a P/E proportion of 15 while its companions have a normal of 25, it might demonstrate undervaluation.

Survey Against Market Midpoints

Contrasting a stock’s P/E proportion to the market normal can give extra setting. For instance, on the off chance that the S&P 500’s typical P/E proportion is 20 and a stock has a proportion of 30, it very well might be exaggerated comparative with the more extensive market.

Dissect Close by Different Measurements

Join the P/E proportion with other monetary measurements, for example,

Stake Proportion (Value/Income to-Development):

Changes the P/E proportion for expected profit development, offering a more nuanced view.

Profit Yield:

For money centered financial backers, a high profit yield might counterbalance a high P/E proportion.

Obligation Levels: High obligation can influence an organization’s future income, making an apparently low P/E proportion less alluring.

Practical Examples: Interpreting P/E Ratios

Example 1: High P/E Ratio

Company A (a tech startup):

- Stock price: $100

- EPS: $2

- P/E Ratio: 50

Investors might justify the high P/E ratio because the company is in a high-growth industry. However, if growth slows or earnings decline, the stock could face a significant price correction.

Example 2: Low P/E Ratio

Company B (a utility provider):

- Stock price: $50

- EPS: $5

- P/E Ratio: 10

The low P/E ratio may reflect the stability of the utility industry. However, it could also signal a lack of growth prospects compared to other sectors.

Conclusion:

A “great” P/E proportion relies upon different variables, including the organization’s business, development prospects, and economic situations. For certain ventures, a P/E proportion of 15-20 may be sensible, while for other people, for example, tech, proportions over 30 can be legitimate. The key is to utilize the P/E proportion related to different measurements and to constantly think about the more extensive setting.

By figuring out the subtleties of the P/E proportion, financial backers can settle on additional educated choices and recognize amazing open doors that line up with their monetary objectives.

you may be interested in this blog here:-

What’s the Difference Between Cyclical and Non-Cyclical Stocks?

What Are Hidden Increases and Misfortunes?