Introduction

In the realm of blockchain and digital currencies, Beginning Coin Contributions (ICOs) have turned into a well known way for new companies and ventures to raise capital. Like a First sale of stock (Initial public offering) in conventional money, an ICO permits organizations to offer advanced tokens to financial backers in return for subsidizing. Notwithstanding, ICOs work in a decentralized and generally unregulated space, making them both a thrilling an open door and an expected gamble for financial backers.

This blog will investigate what an ICO is, the manner by which it works, its advantages, dangers, and how to partake. Whether you’re a financial backer considering ICOs or basically inquisitive about how they fit into the cryptographic money scene, this guide will give the fundamental information you really want.

What is an ICO

An Underlying Coin Offering (ICO) is a raising money component where blockchain projects issue and offer computerized tokens to financial backers. These tokens can address utility inside the task, possession freedoms, or different advantages.

How ICOs Work

Organizations or tasks make tokens on a blockchain (e.g., Ethereum).

Financial backers buy these tokens utilizing digital currencies like Bitcoin or Ether (ETH).

Reserves raised are normally used to foster the task, and financial backers get tokens with explicit utility or worth.

Types of Tokens Issued in ICOs

Utility Tokens: Give admittance to an item or administration inside the biological system.

Security Tokens: Address possession or a stake in the task, frequently dependent upon administrative examination.

How Does an ICO Work

Step-by-Step Process of an ICO

Whitepaper Release

The task group distributes a whitepaper illustrating the objectives, innovation, use cases, tokenomics, and guide.

The whitepaper is the center archive that illuminates possible financial backers about the task.

Token Creation

Tokens are made utilizing blockchain stages like Ethereum, Binance Brilliant Chain, or Solana.

Ethereum’s ERC-20 standard is the most regularly utilized for ICO tokens.

Pre-Sale and Public Sale

Pre-Deal: Tokens are offered to early financial backers at a limited rate.

Public Deal: Tokens are made accessible to the overall population.

Token Distribution

When the ICO closes, tokens are conveyed to financial backers.

These tokens can be recorded on digital money trades for exchanging or utilized inside the task environment.

Project Development

Reserves raised are utilized to foster the stage or administration guaranteed in the ICO.

Benefits of ICOs

- Admittance to Beginning phase Ventures

Financial backers get the opportunity to help projects in their beginning phases, possibly prompting huge returns on the off chance that the task succeeds. - Democratized Raising support

ICOs eliminate conventional boundaries to section for subsidizing, permitting anybody with digital currency to contribute. - Development and Decentralization

ICOs advance development by empowering the improvement of decentralized stages and applications. - Liquidity of Tokens

Tokens gave during an ICO can frequently be exchanged on trades not long after the contribution, giving liquidity to financial backers. - Lower Expenses for New businesses

Contrasted with conventional gathering pledges strategies like investment, ICOs include less delegates, decreasing expenses for new companies.

.Risks and Challenges of ICOs

Lack of Regulation

- Most ICOs work in an unregulated space, making them helpless to misrepresentation and tricks.

- Financial backers frequently have minimal lawful plan of action if there should arise an occurrence of unfortunate behavior.

High Volatility

Tokens can experience extreme price volatility, leading to potential losses for investors.

Incomplete Projects

Many tasks neglect to follow through on their commitments because of unfortunate administration, specialized difficulties, or inadequate financing.

Security Risks

ICOs have been focused on by programmers, bringing about lost assets for the two financial backers and undertakings.

How to Participate in an ICO

Stage 1: Exploration the Undertaking

Peruse the Whitepaper: Grasp the venture’s vision, objectives, and token utility.

Group and Consultants: Investigate the certifications and experience of the group.

Local area and Straightforwardness: Join the undertaking’s web-based local area and survey its correspondence.

Stage 2: Set Up a Wallet

Make a cryptographic money wallet that upholds the ICO’s symbolic norm (e.g., ERC-20 for Ethereum tokens).

Wallets like MetaMask, Trust Wallet, or equipment wallets like Record are well known choices.

Stage 3: Purchase Digital currency

Buy the expected digital money (e.g., ETH or BTC) from a trade to partake in the ICO.

Stage 4: Register for the ICO

Follow the venture’s true channels to pursue the ICO. Be careful of phishing tricks.

Stage 5: Contribute and Get Tokens

Move cryptographic money to the venture’s wallet address.

After the ICO closes, tokens will be dispersed to your wallet.

Successful ICO Examples

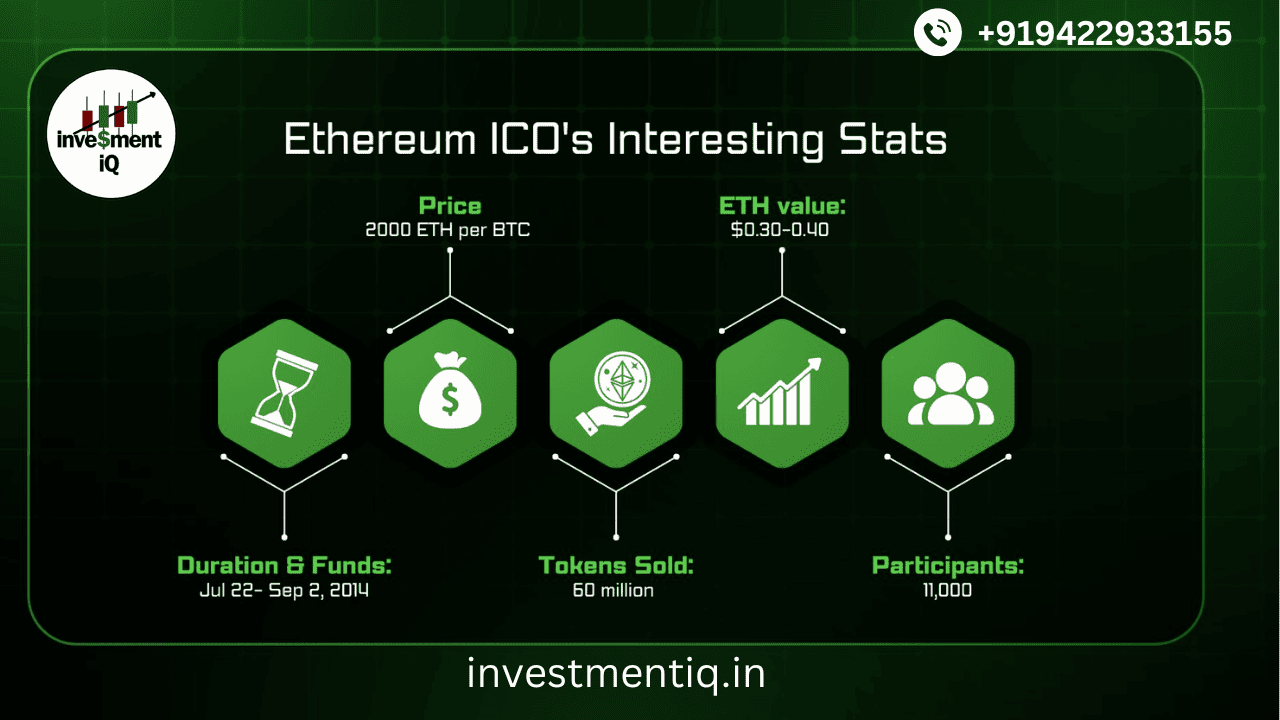

- Ethereum (2014)

Raised $18 million to fabricate the Ethereum blockchain, which currently drives most ICOs and decentralized applications. - Filecoin (2017)

Raised $257 million to foster decentralized information capacity arrangements. - EOS (2017-2018)

Directed an extended ICO, raising more than $4 billion for a versatile blockchain stage.

These ventures feature the capability of ICOs when supported areas of strength for by and imaginative thoughts.

The Future of ICOs

ICOs have developed since their top in 2017. While administrative investigation and contest from elective gathering pledges strategies like Security Token Contributions (STOs) and Introductory Trade Contributions (IEOs) have diminished their predominance, ICOs stay a fundamental piece of the blockchain environment.

Conclusion

Beginning Coin Contributions (ICOs) address a notable method for bringing assets up in the blockchain period. They enable new companies to advance and financial backers to take part in beginning phase projects with critical potential. In any case, they likewise accompany chances, including unpredictability and absence of guideline.

By directing intensive examination, figuring out the dangers, and following accepted procedures, you can explore the universe of ICOs certainly. As blockchain innovation keeps on developing, ICOs will stay an integral asset for driving advancement and development in decentralized frameworks.