The Difference Between a Taxable Brokerage and an IRA: A Comprehensive Guide

With regards to effective money management, understanding the various kinds of records accessible to you is critical for settling on informed choices that line up with your monetary objectives. Two of the most widely recognized sorts of speculation accounts are available money market funds and individual retirement accounts (IRas). While both permit people to put resources into a great many resources, like stocks, securities, shared assets, and ETFs, they vary essentially as far as expense treatment, commitment limits, withdrawal rules, and long haul benefits.

In this blog, we’ll investigate the vital contrasts between available money market funds and IRAs, so you can figure out which is the most ideal for your monetary procedure.

What is a Taxable Brokerage Account?

An available investment fund is a standard venture account where you can purchase, sell, and hold different monetary resources, like stocks, securities, shared assets, and the sky is the limit from there. The expression “available” alludes to the way that you will owe charges on any income created inside the record.

The principal benefit of an available money market fund is its adaptability. There are no limitations on the amount you can contribute, when you can contribute, or when you can pull out cash. You can likewise exchange resources unreservedly, which makes it an optimal record for those looking to deal with their ventures effectively.

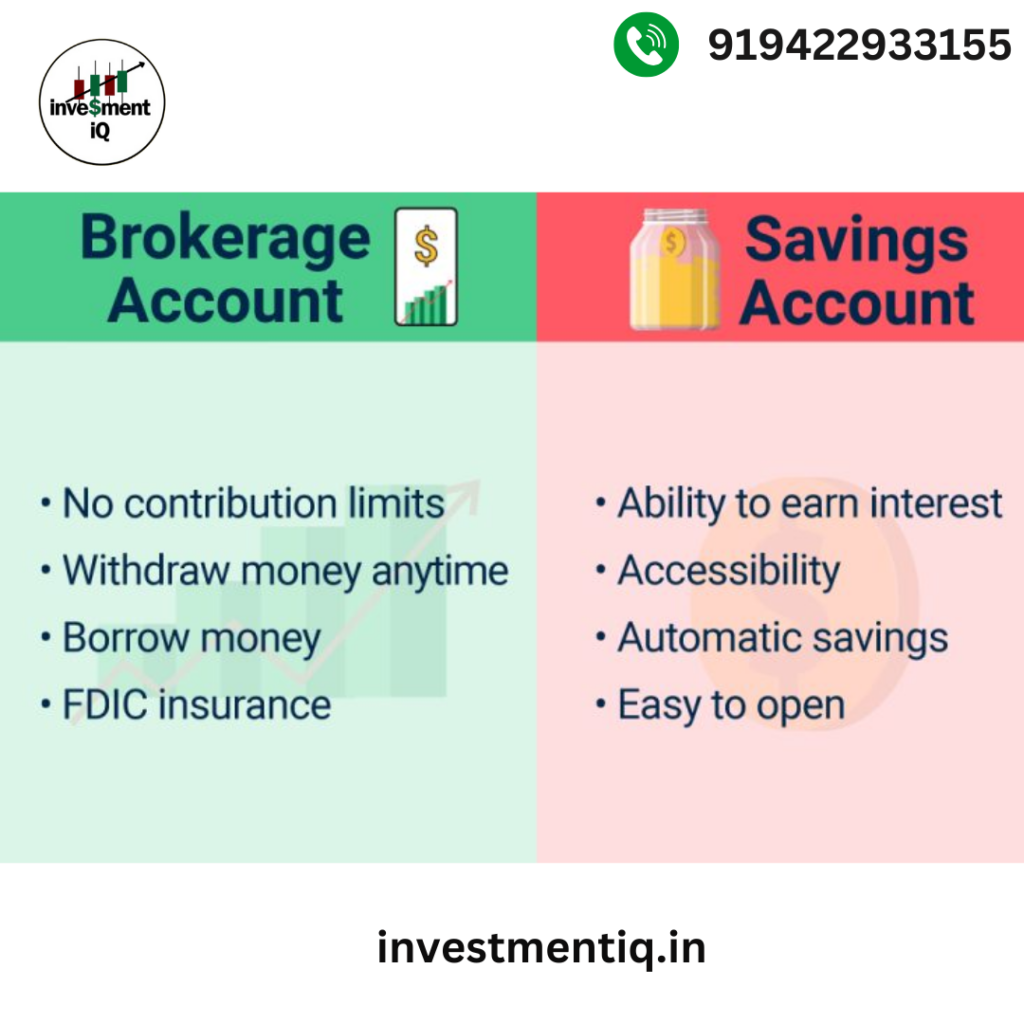

Key Features of a Taxable Brokerage Account:

No Commitment Cutoff points:

You can put away as much cash as you need into an available money market fund with next to no administration forced commitment limits.

Charges on Income:

You will owe charges on any capital additions (benefits from selling ventures), profits, and premium procured inside the record. These duties are for the most part due in the year the profit are understood.

Capital Additions Duties:

On the off chance that you sell a resource for more than whatever you paid for it, you’ll owe capital increases charge. The rate really relies on how long you held the resource. On the off chance that you held it for under a year, you’ll pay momentary capital increases charge (which is equivalent to your common personal expense rate). In the event that you held it for over a year, you’ll pay long haul capital additions charge, which is commonly lower.

Profit Expenses:

On the off chance that you acquire profits on your ventures, they might be available as either qualified profits (likely to bring down charge rates) or customary profits (dependent upon higher duty rates).

No Withdrawal Limitations:

You can pull out cash from an available investment fund whenever, under any condition, without punishments. In any case, withdrawals might be dependent upon capital additions charge, contingent upon the planning of the deal.

No Expected Least Conveyances (RMDs):

Dissimilar to retirement accounts like IRAs, there are no obligatory withdrawals from an available investment fund. You can leave your cash contributed however long you need without being compelled to take appropriations.

Adaptability in Resource Decisions: Available money market funds give you the opportunity to put resources into a wide assortment of resources, including stocks, securities, land speculation trusts (REITs), and choices.

Charge Misfortune Collecting:

Assuming you have misfortunes in your available money market fund, you might have the option to balance your benefits with those misfortunes, diminishing your general duty responsibility. This methodology, known as expense misfortune collecting, can be helpful for limiting charges on your venture returns.

What is an IRA?

An Individual Retirement Account (IRA) is a tax-advantaged investment account designed to help individuals save for retirement. There are two primary types of IRAs: Traditional IRAs and Roth IRAs. While both types offer tax benefits, they differ in terms of tax treatment and rules around withdrawals.

The main purpose of an IRA is to incentivize long-term saving by offering tax benefits that help you build wealth for retirement.

Key Features of an IRA:

Commitment Cutoff points:

Dissimilar to available money market funds, IRAs have yearly commitment limits. For 2024, as far as possible for both Conventional and Roth IRAs is $6,500 ($7,500 for people 50 and more established), however these cutoff points can change every year.

Charge Treatment:

The greatest distinction between an IRA and an available money market fund is how duties are taken care of.

Customary IRA:

Commitments to a Conventional IRA might be charge deductible, which diminishes your available pay for the year. In any case, when you pull out cash from a Customary IRA in retirement, the withdrawals are burdened as standard pay. The advantage is that your cash develops charge conceded, meaning you don’t pay charges on the venture gains until you pull out them.

Roth IRA:

Commitments to a Roth IRA are made with after-charge dollars, meaning you don’t get a quick duty derivation. In any case, the profit and withdrawals from a Roth IRA are for the most part tax-exempt, gave you keep the guidelines to qualified disseminations. Roth IRAs are frequently preferred by the people who hope to be in a higher expense section in retirement, as you will not owe charges on the withdrawals later on.

Charge Conceded or Tax-Exempt Development:

Both Customary and Roth IRAs offer the advantage of duty conceded development. This implies you will not owe charges on profits, premium, or capital increases inside the record until you pull out the assets (or on account of a Roth IRA, never). This permits your speculations to intensify all the more productively after some time, contrasted with an available investment fund where you pay burdens every year on your income.

Withdrawal Limitations and Punishments:

One of the main disadvantages of IRAs is the withdrawal limitations. For both Conventional and Roth IRAs, withdrawals before the period of 59½ are dependent upon a 10% early withdrawal punishment, notwithstanding ordinary personal duties for Customary IRA withdrawals.

Customary IRA:

You should start taking Required Least Conveyances (RMDs) from your Conventional IRA at age 73 (starting around 2024). These are least sums that should be removed every year. Inability to take RMDs can bring about steep punishments.

Roth IRA: While Roth IRAs don’t need RMDs during the record holder’s lifetime, they in all actuality do have severe principles about withdrawals. To take tax-exempt withdrawals of profit, you probably held the record for no less than five years and be somewhere around 59½ years old.

Speculation Choices:

Like available money market funds, IRAs permit you to put resources into various resources, including stocks, securities, shared assets, ETFs, and land. Be that as it may, there are a couple of limitations on specific kinds of speculations, like collectibles or extra security.

Adaptability in Commitment Timing:

For IRAs, commitments should be made by the assessment recording cutoff time for the earlier year (as a rule April 15 of the ongoing year) to be applied to the earlier year’s government form. Commitments to available money market funds, then again, can be made whenever.

Taxable Brokerage Account vs. IRA: A Comparison

| Feature | Taxable Brokerage Account | Traditional IRA | Roth IRA |

|---|

| Contribution Limits | No limit | $6,500 ($7,500 if 50 or older) | $6,500 ($7,500 if 50 or older) |

| Tax Treatment | Taxes on gains, dividends, and interest annually | Tax-deductible contributions, tax-deferred growth | After-tax contributions, tax-free growth |

| Withdrawals | Unlimited, subject to capital gains tax | Taxed as ordinary income, penalties before 59½ | Tax-free (if conditions met), penalties before 59½ |

| RMDs | None | Required starting at age 73 | None |

| Flexibility | Full flexibility | Limited by contribution limits and withdrawal rules | Limited by contribution limits and withdrawal rules |

| Tax-Advantaged Growth | No | Yes (tax-deferred) | Yes (tax-free) |

Which is Right for You?

Choosing between a taxable brokerage account and an IRA depends on your financial goals, time horizon, and tax situation. Here are some general guidelines:

Use a Taxable Brokerage Account if:

- You want flexibility in contributions and withdrawals.

- You’re not yet focused on retirement or need to access funds before retirement age.

- You want to invest more than the annual IRA contribution limits allow.

- You prefer to manage your investments actively without worrying about early withdrawal penalties or required minimum distributions.

Use an IRA if:

- You’re focused on retirement savings and want to take advantage of tax benefits.

- You can handle the restrictions on withdrawals and contribution limits.

- You’re looking to minimize taxes on your investments over the long term, especially if you’re planning to make tax-deferred (Traditional IRA) or tax-free (Roth IRA) withdrawals in retirement.

Conclusion

Both available investment funds and IRAs offer special advantages and downsides, and the ideal decision for you relies upon your own monetary objectives. Assuming you’re searching for long haul retirement reserve funds with tax cuts, IRAs are a brilliant choice. In any case, on the off chance that you need greater adaptability and admittance to your speculations without stressing over punishments or limits, an available money market fund might be more reasonable. For some people, a blend of both record types can offer a balanced venture technique. By understanding the key distinctions, you can pursue informed choices that line up with your monetary goals and enhance your speculation returns.

you may be interested in ths blog here:-

What’s the difference between Treasury bonds, notes, and bills

Can I Open a Brokerage Account for My Child

What is the Contrast Between Favored Stock and Normal Stock?